Last Updated on by Ed Harris

Ohio healthcare Marketplace changes and reform impact the way you purchase your medical coverage, the rate you pay, the benefits you receive, the cost of Exchange plans, and the amount of taxes you pay. Wow! That’s a lot of changes! We will review the differences and updates you are likely to see, what you can do about them and how you can reduce the price you pay for your benefits. The timeline keeps changing so we constantly update our content.

As Presidents and their Administrations change, you can safely assume that the state and federal healthcare system will change. Proposed reforms have not been fully enacted, but if completed, many additional options could be offered. The American Health Care Act was designed to replace most of the Affordable Care Act, but Congress did not agree to pass the legislation. Additional tweaks and legislation are likely to be proposed in future Administrations.

How You Buy A Policy

The actual purchase process is sometimes tweaked, but is typically not drastically altered. We will always continue be a primary website where you can start the application process by providing your zip code at the top of the page. Subsequently, you will be provided with additional information which includes plan comparisons, federal tax-subsidy (tax credit) eligibility calculations and of course, current Marketplace rates.

Medical questions have not been asked since 2013, since all policies will be approved (with a few exceptions). But premiums are not lower for every applicant, because of the increased health risks associated with accepting everyone that wants to buy a policy. Ask us. We will quickly calculate your rates and discuss your best choices.Your options change each year, since new carriers and plans are offered, and many existing plans are no longer available.

Applicants that are eligible for Medicare or Medicaid can not utilize federal subsidies. However, premiums are generally substantially less than unsubsidized under-65 Marketplace plans. Seniors can compare Medicare Supplement, Advantage, and Part D prescription drug plans on our website. Plan availability and cost of coverage will impact Advantage and Supplement policies. During Open Enrollment, medical questions are not asked.

The Type Of Coverage I Can Get

Previously, there were about 1,000 different combinations of policy benefits you could have bought. If you consider different policies, deductibles, coinsurance, riders, rate-ups and upgrades, along with the more than 10 major insurers in Ohio, you could easily have spent a week attempting to review every possible scenario. Of course, we were usually able to identify the 10-15 options that were the most economical for you.

The Ohio Health Insurance Exchange is the current method to enroll, although the number of available combinations of benefits has drastically reduced. However, the process is often very time-consuming, since understanding your best options is not always apparent. Wait times can be long, and customer service representatives are not local. Once again, that’s where we will assist you.

You will be able to purchase either a Platinum, Gold, Silver or Bronze plan. They are commonly referred to as “Metal” policies. Although Anthem Blue Cross, Medical Mutual, CareSource, Humana, Ambetter, SummaCare, and remaining carriers don’t have to offer all four options, they must make available both a Silver And Gold contract. The variable is which carriers choose to participate in the Marketplace since they select specific states to offer their policies.

Previously, the following companies offered private medical plans in the Buckeye State: Medical Mutual, Anthem Blue Cross, Healthspan, Humana, Molina, SummaCare, Ambetter, Kaiser Permanante, CareSource, Aetna, and UnitedHealthcare. However, the number of participating carriers continues to decline (in most states). If new legislation is approved, it is expected more companies will become available, especially when it is permitted to sell plans across state lines.

Required Medical Coverage

“Essential Health Benefits” must be included. These are mandated (required) coverage, such as maternity, mental health, lab and emergency services, pediatric dental, office visits, and prescriptions, that are required (by law) to be part of all contracts. However, each Metal policy has different sharing of these costs.

The Platinum option requires less sharing, since 90% of expected expenses will be covered. The Bronze option is the cheapest since consumers pay (on average) 40% of the expenses. The catastrophic option has the most cost-sharing, and is often less expensive than Bronze plans. Silver plans should always be included in comparisons, since they frequently offer the best value when considering both cost and potential worst-case-scenario situations that involve a major medical claim.

NOTE: Beginning in 2021, it is possible that each state (including The Buckeye State), will create their own customized set of required benefits. Coverage will be based on local legislation, instead of federal legislation.Thus, maternity, mental illness, and several other benefits, may vary, depending where you reside. It’s also possible that short-term plan benefits may be enhanced. Previously, teledoc coverage was expanded for the COVID-19 virus in 2020.

If Exchange Prices Are Too Expensive, Then What?

You can buy Ohio health insurance plans away from the Marketplace. It is estimated that more 30 million people purchase these types of policies in the US. There is more flexibility, so it will be easier to find a plan that closely matches your needs. The number of participating providers is often higher and prices are sometimes lower. However, it is extremely important to allow an experienced resource review the costs, benefits, and maximum out-of-pocket expenses to ensure the plan is legitimate. Please contact us any time for assistance.

The availability of these plans is found on our website when a quote is requested. It is required that Marketplace carriers who offer options “outside” must also offer “inside.” So while all companies don’t write business, we expect quite a few to continue to participate. If you are not eligible for the federal subsidy, quality benefits and multiple choices are still offered. We always closely watch “Outside Of The Exchange” contracts.

Is The Affordable Care Act (Obamacare) Going To Be Repealed, Altered, Or Replaced?

It is possible. Many of the changes that we have seen over the last few 10 years (and upcoming changes) are likely here to stay. However, there could be major revisions since prices have started to spiral out of control. It is expected that rates could potentially begin to reduce in 2021 and beyond. The projected prices from the Congressional Budget Office (CBO) show a downward trend, although each state may have additional control over which plans are offered. Currently, states regulate short-term plan availability, and the maximum duration of each plan.

Are Rates Still Increasing?

Yes, although rate increases are not as substantial as in previous years. For example, four years ago, the average increase was approximately 30%-40%. Current annual increases are much less, and it is hopeful that future legislation will stabilize prices. With the possible creation of high-risk pools for applicants with major medical health conditions, lower premiums may actually occur. Future Administration initiatives have not become effective yet, so immediate rate decreases are unlikely.

Past Lieutenant Governor Mary Taylor correctly pointed out that the number of available choices for consumers is significantly dropping. About a dozen companies offer up to 200 policies (total) for single persons or single or married persons with dependents. Six years ago, increases averaged only 8%, which was a major decline from the previous year. Since that time, increases have been higher and less plans are available, although Anthem has returned to the Ohio Marketplace.

What Kind of Health Insurance Plans Will Be The Most Popular In Ohio In The Future?

High-deductible plans (also known as HSAs) may be the wave of the future. Perhaps not for everyone, but certainly for persons that have reasonable earned income and don’t receive large federal subsidies to help reduce their rates. As employers slowly start to reduce the number of workers that are offered group healthcare, affordable popular individual plans will become available. Future pandemics (such as COVID-19) may create expanded Open Enrollment periods, and additional assistance from the Federal Government.

Low-cost catastrophic plans that do not automatically cover maternity, mental illness, and other benefits, may be introduced in the future, if proposed legislation passes. These policies will feature large out-of-pocket expenses, and may be HSA-eligible. However, they would not be ideal options for young growing families. Ancillary products may become available to be utilized in conjunction with the new high-deductible plans. Long term health care and disability options are two examples.

Can You Provide Some Specific Examples?

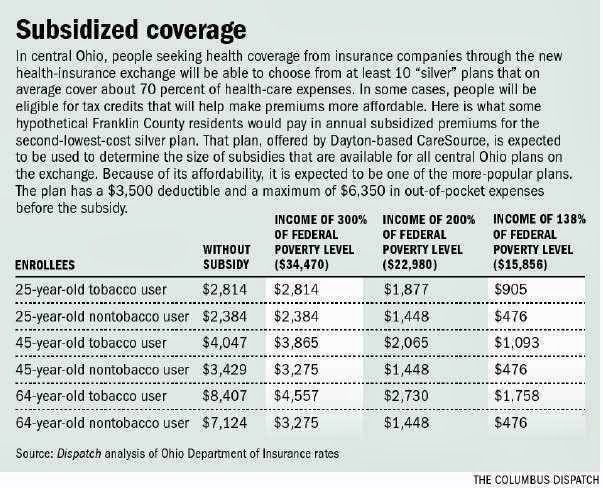

Perhaps the illustration below will help. The Columbus Dispatch has provided a nice infographic showing some sample prices. Naturally, qualifying for a subsidy makes a very big difference in the premium. Smoking also increases the rate approximately 18%. Silver plans are the only Metal-tier option that can reduce your deductible based on your FPL level. Catastrophic plans do not receive federal aid, and often are more expensive than Bronze-tier options.