Affordable Ohio Health Insurance – Individual And Medicare Plans

Compare the lowest rates for your Ohio Health Insurance plans. Whether you are an individual, family, self employed, Senior, student, or uninsured, our expert guidance and experience allows you to view and learn about the most affordable on or off-Marketplace health insurance in Ohio. Easily review all private and ACA plans in your area, and customize the copays, deductibles, and rate that fits your budget. 2026 short-term gap coverage, long-term options, Exchange, Medicaid, and 65+ Medicare products can also be viewed.

We also help you understand and calculate your free federal subsidy that can reduce your premium. Both subsidized Obamacare and non-ACA plans are available. Enrolling in a new plan takes only 15-20 minutes. By comparing coinsurance, drug benefits, primary-care-physician, and specialist office visit copays, and maximum out-of-pocket expenses, inexpensive and reasonably-priced plans can be reviewed. You can choose comprehensive coverage or the cheapest available high-deductible (HSA) major medical plans. Low-deductible and low-copay options are also offered. The maximum allowed 2026 deductible for non-HSA plans is $10,600.

Our free guides help you find the best policy for subsidized and non-Obamacare plans. Policies are offered with comprehensive office visit and prescription drug benefits, along with low-cost major medical catastrophic benefits. Shop Anthem Blue Cross, Medical Mutual, UnitedHealthcare, CareSource, Humana, Cigna, Ambetter, Molina, SummaCare, Oscar, Paramount, and other carriers. Obtain coverage during Open Enrollment or with a qualifying life event that allows you to easily enroll online. Platinum, Gold, Silver, Bronze, and Catastrophic Tiers offer a variety of options from several carriers. Many plans offer immediate $0 premiums.

Regardless if you reside in Columbus, Cleveland, Toledo, Cincinnati, or any other Buckeye State city, many plans are offered that reduce your out-of-pocket expenses. Qualified under-65 plans provided unlimited benefits with no annual or lifetime caps on covered items. Inpatient and outpatient coverage is immediately covered when a policy begins. Physical therapy, mental illness, and maternity benefits are included with no waiting period or special deductible. Maternity and newborn coverage is included on all plans without adding a rider or waiting period. Note: The test benchmark for determining affordability of group healthcare plans increases to 9.96% of an employee’s 2026 household income (up from 9.02% last year).

The “pay or play” rules require companies with 50 or more full-time workers to provide “affordable minimum value” healthcare benefits to their workforce. Three benchmarks (considered safe harbor for 2026) are available: Form W2 (policy rate can not be larger than 9.96% of W-2 Box 1 pay),

Senior Medicare Plans In Ohio

You can also view Senior Medigap plans. Choose among Medicare Advantage (MA), Supplement, and Part D prescription drug coverage offered by multiple companies. If you have reached age 65, you are probably eligible for benefits. Original Medicare (Parts A and B) does not provide complete coverage for all expenses, including hospital stays, skilled nursing, and doctor bills. Unlike private plans, Medicare is managed by the federal government, and the provider network covers the majority of physicians, specialists, medical facilities, and hospitals. Consumers are not required to purchase Medigap coverage.

Twelve standardized plans are offered (A through L) with requirements and limitations fully explained. A high-deductible Plan F option provides 100% coverage after the deductible has been met. For new enrollees, a high-deductible Plan G is offered, which provides a single deductible with 100% coverage after the deductible has been met. The plan deductible is $2,800, and benefits are the same as regular Plan G once the deductible is met. Several Plan G benefits include Part B excess charges, Part B co-payment or coinsurance, Part A hospital costs and coinsurance, and skilled nursing care facility coinsurance.

For 2026 plans, $615 is the maximum deductible. Copays are then paid with a maximum out-of-pocket expenses of $2,100 on prescriptions. The cap includes coinsurance, copays, and deductibles, and eliminates the “donut hole.” The Part D base monthly premium is $36.78, although costs can slightly vary in different areas. There is also a 6% cap on base Part D premiums. Out-of-pocket costs can be spread out throughout the year with monthly payments.

The least expensive option for new applicants is Plan G, a high-deductible (HD) plan. In most counties, including Montgomery, Franklin, Hamilton, and Cuyahoga counties, the following carriers offer plans that cost less than $50 per month for a 65-year-old male – New Era Life, United American, Medico, United States Fire, Bankers Fidelity, Mutual Of Omaha, Elips Life, Humana, Ace Property And Casualty, and Continental Life. Additional carriers that offer Part F (HD) plans to existing carriers for less than $50 per month include Great Southern Life, United American, New Era Life, Allstate, Humana, and Medico.

Ohio Part D prescription drug plans are offered by the following companies: AARP, Anthem, Cigna, Clear Spring Health (Sanctioned plans), Humana, SilverScript, and Wellcare. CMS (Centers for Medicaid and Medicare Services) plan ratings provide a system that compares plans with 1-5 star designations. Rx Cost info rating, Plan ID, Summary Star Rating, and formulary drug lists are also provided. CMS also provides a unique ID for each plan and designates whether gap coverage is included. The standard deductible is $615. Covered insulin is typically available for under $35 on all plans.

Sixteen Part D plans are offered with two $0 deducible options available. Four plans feature premiums less than $25 per month and the average monthly cost of all plans is $61.54. Seven plans had premium increases in 2025 while seven plans also had rate increases. Approximately 20% of all policyholders had rate increases.

LIS (Low-Income Subsidy) Qualifying plans are Clear Spring Health Value Rx and WellCare Classic. LIS assists applicants with lowering the cost of their drugs and the cost of coverage. If a covered person might no longer qualify for LIS, CMS will send a form in September. A new application is also enclosed with a postage-paid envelope in case coverage should be retained. It’s also possible that the copays may change or a new prescription drug plan will be issued effective January 1. You can change prescription drug plans each year, although a comprehensive review of potential out-of-pocket costs should be completed.

The least expensive plans are Wellcare Value Script, Clear Spring Health Value Rx, Cigna Healthcare Saver Rx, Wellcare Classic, Humana Value Rx Plan, and SilverScript Choice. Preferred generic, generic, preferred brand, non-preferred, and specialty drugs are covered. Formulary drug lists are provided by all carriers. Most plans cover the donut hole discount, but do not provide additional gap coverage.

Medicare Advantage (MA) plans in Ohio are popular options for Seniors. Approved private carriers offer comprehensive benefits that often include prescription drug, dental, vision, and hearing benefits. Network providers help lower out-of-pocket costs with HMO, PPO, PFFS, and SNP contracts. Contracts with the highest 2025 enrollment include: AARP Medicare Advantage from UHC, AARP Medicare Advantage Essentials from UHC,Aetna Medicare Assure 1, Aetna Better Health Of Ohio, Aetna Medicare Value, Anthem Medicare Advantage, Anthem Full Dual Advantage, Anthem Medicare Advantage 3, Anthem Veteran, Anthem Extra Help, Buckeye Health Plan – MyCare Ohio, CareSource Dual Advantage, CommuniCare Advantage ISNP, Devoted DUAL PLUS Ohio, Devoted Choice Ohio, Humana Gold Plus, Humana USAA Honor Giveback, HumanaChoice, HumanaChoice Giveback, Humana Cleveland Clinic Preferred, MedMutual Advantage Classic, MedMutual Advantage Signature, MedMutual Advantage Access, Mount Carmel MediGold No Premium, Mount Carmel MediGold Premier, Molina Dual Options MyCare Ohio, SummaCare Medicare Topaz, The Health Plan SecureCare SNP, Wellcare Simple, and Wellcare Dual Access.

Your free under-65 Marketplace quotes are the best available prices allowed by each carrier, and there are no costs or obligations. We also discuss and review the impact that the Affordable Care Act and the current Administration will have on your specific situation. New plans and carriers may enter the marketplace in future years. Additional budget-friendly high-deductible options may also be introduced, along with flexible temporary plans. Regardless of which political party in office, pre-existing conditions will continue to be covered on specific plans. A “public option” has been discussed, but has never been implemented.

Ohio Open Enrollment For Health Insurance ACA Plans – Apply Online

Open Enrollment in Ohio for the Health Insurance Exchange and Marketplace plans begins every November 1st for new effective dates. However, SEP exceptions are available the entire year. This federally-facilitated Marketplace allows you to buy your 2026 private individual, family or small business healthcare without risking denial for underwriting reasons. Pre-existing conditions are covered, and no waiting periods or surcharges will be imposed. Exchange enrollment was higher than last year, despite recent Medicaid expansion. Non-Obamacare options are also offered, although all “essential benefits” may not be included.

The effective date of coverage for these policies is typically January 1. If you apply after December 15th with a qualifying life event (QLE), it is possible your effective date will be later than January 1st. Although the .Gov website has experienced major delays and glitches in previous years, our website offers identical rates and we have had no software issues. We also provide an easier enrollment process that will save hours of time and frustration, since we handle the bulk of the work for you.

Anthem Blue Cross returned to the Buckeye State several years ago and now provides coverage in all counties. Rates will vary, and the number of available network providers will also vary by county. They also have secured an agreement with Ohio State University to provide several plan options. The OhioHealth system is also provided to all state residents. Three years ago, an extended Open Enrollment was granted from February 15-August 15 because of the COVID pandemic.

NOTE: Open Enrollment for Seniors (Age 65 and older) always starts earlier (October 15 – December 7). Medicare Supplement and Advantage plans (that replace original Medicare) are popular Medigap options that can reduce out-of-pocket expenses, such as deductibles and copays. Part D prescription drug coverage is also offered, although sometimes included in Advantage contracts. An additional enrollment period takes place when you reach age 65, regardless of the time of year.

Many companies (Allstate, Cigna, Aetna, Wellcare, United Of Omaha, Woodmen Of The World, Medico, USAA, Kaiser, and Humana) offer Medigap plans to Seniors, but not private individual coverage if you are under age 65. AARP and UnitedHealthcare together offer numerous Senior Medicare products that feature high enrollments in many counties.

Three New Companies

Three companies began participating several years ago. They were UnitedHealthcare (UHC), Aetna, and Premier. Premier serviced the Dayton area and surrounding counties, and also offered Senior products. UHC has offered short-term coverage for many years under the brand name of “Golden Rule.” UHC rates were very attractive, and they previously offered popular HSA plans. However, Aetna and Premier are not currently offering Ohio Marketplace coverage. Group and Senior plans are not impacted and non-compliant options are limited, but available.

NOTE: Several carriers may be returning in 2027, depending on the Administration’s guidelines. Aetna has returned in other states already. The Buckeye State is very popular with most carriers because of favorable and competitive premiums and a Department of Insurance that supports carriers and consumers. UnitedHealthcare continues to offer coverage in many counties in the Buckeye State. Their short-term plans (maximum four-month duration) are a popular temporary healthcare option.

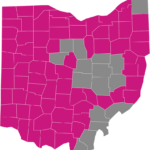

In many areas of the state, Ambetter’s pricing is very competitive. Typically, they offer some of the cheapest office-visit copay plans in the state, and the network-coverage includes most counties. Several of their least expensive plans are Standard Expanded Bronze, Everyday Bronze, Choice Bronze HSA, and Clear Gold. Vision and adult dental benefits can be added. Deductibles do not apply to most office visits, and many prescriptions are covered with only copays. Ambetter’s Ohio service area is shown below:

Medical Mutual also offers a combination of comprehensive coverage and inexpensive rates. Popular plans include Bronze $8,300, Bronze HSA $7,300, Bronze Standard, Silver Standard, and Silver $5,800. Additional 2026 plans that feature lower rates are: Oscar Bronze Classic Standard, Oscar Bronze Classic 4700, Oscar Bronze Simple Diabetes, Antidote Bronze Complete, and Antidote Bronze Elite.

Aetna No Longer Offers ACA Plans In Ohio

Aetna is also one of the largest carriers in the US and previously offered several low-cost options in four other states. For example, their Bronze-tier “$20 Copay” option was one of the most affordable comprehensive options that was previously offered in the Columbus area (and Franklin County). In earlier years, they featured a low $20 copay (only) on primary care physician visits without having to meet the deductible. It was a “point of service” managed care plan and these types of plans were popular Group options for employees.

Aetna, is not providing Marketplace plans in the Buckeye State. The least expensive Aetna ACA Plans last year were: Bronze 2 Advanced HSA, Bronze S, Bronze 4 Advanced, and Silver 5 Advanced. Aetna Medicare Advantage (MA) plans in the Buckeye State include Better Health Of Ohio, Medicare Assure 1, Eagle, Premier, Premier 1, Premier 2, Premium Plus 1, Premium Plus 2, SmartFit, Longevity Plan, Select, Value PPO and Value HMO.

It is possible that Aetna will begin offering coverage in additional states within the next several years, depending when (or if) specific changes are made to the Affordable Care Act legislation. Currently, their network is utilized in Allstate’s short-term plans, which provide four months of inexpensive temporary benefits. Although benefits are capped at $1 million per year, the Allstate plan provides a popular alternative to healthy applicants that don’t qualify for a federal subsidy. Urgent Care and telemed visits are covered with only a copay, and without a deductible to meet. Up to 36 months of guaranteed coverage was previously offered with the short-term plan.

Oscar offers very competitively-priced plans (including an HSA) in the Columbus and Cleveland areas, and have expanded in other counties. The Cleveland Clinic is included in the network. Previously, Medical Mutual was one of the few carriers that included the Cleveland Clinic in its network. Oscar has slowly been expanding their footprint in Ohio the last five years. Oscar 2026 Silver-tier plans include: Silver Simple PCP Saver, Silver Classic Standard Select, Silver Simple Chronic Care CKM, Silver Simple Diabetes, and Silver Elite Saver Plus.

Anthem Blue Cross began offering an underwritten short-term plan five years ago. “Enhanced Choice” provided comprehensive benefits with six optional deductibles and pre-existing conditions covered. Since the plan did not include all essential health benefits, a federal subsidy was not available. The cost of coverage was less than an unsubsidized Marketplace plan. Office visit and prescription drug benefits were included for all family members, and the Anthem Blue Cross national network was available. This Anthem plan was discontinued in 2024. UnitedHealthcare, however, offers more competitively-priced temporary contracts. Allstate also features temporary plans at competitive rates.

What Happens If I Miss The Deadline?

Even though Open Enrollment ends, there are still low-cost plans that will provide quality coverage. And actually, many of the top-rated companies (Anthem and UnitedHealthcare) underwrite these plans. For example, short-term coverage, which can be kept as long as 3-12 months, provides valuable benefits until the next OE period at the end of the year. The application is short and takes less than 20 minutes to complete. If you need the policy quickly, your wait will likely be less than 24 hours. The policy can also be canceled at any time without a penalty. If COBRA or guaranteed coverage through as Exchange plan is offered, these options should be considered.

Additional products (critical illness, disability, life, dental, and vision) can be purchased at any time. Allstate (see above) utilizes the Aetna and Cigna PPO networks, and is another popular short-term option. Companion Life underwrites indemnity plans, which have no network provider restrictions. Coverage is available with benefit amounts as low as $100,000, and the simplified indemnity application takes about 15 minutes to complete. Anthem’s short-term plans can potentially cover pre-existing conditions, although policy premiums are higher than most other similar plans.

Temporary plans have become extremely popular with consumers who do not want to participate in the Marketplace and prefer to purchase simple major medical coverage that provides “no frills” benefits. Office visit and major medical benefits are available for up to one year. You can also re-apply for new coverage, or select a different carrier and policy. Many riders can be added to help reduce out-of-pocket costs of high inpatient hospital bills. If the medical insurance portion is terminated, dental and vision benefits may be retained.

“Special” enrollment periods are offered if you qualify for several exclusions. These are discussed later in the article. For example, if you lose existing coverage from a divorce, move to a different service area, leave your employer, or adopt a child, you are generally eligible to apply. When COBRA benefits end, an approved qualifying life event (QLE) is granted. You may enroll in a plan without underwriting approval. Native Americans can enroll throughout the entire year.

Other benefit-specific policies may be ideal for keeping premiums within your budget after the deadline passes. The range of coverage will vary. First-dollar plans, limited-benefit and more comprehensive policies can be easily compared and designed specifically to fit your needs. Simply ask us about them! However, if a policy does not comply with ACA guidelines, although you will not be assessed a penalty, critical benefits may be lacking or missing. Critical-illness and disease-specific (cancer, for example) contracts are more suitable for supplemental benefits, and not primary coverage. Property and casualty products can be purchased at any time, along with life and disability products.

What Impact Does The US Presidency Have On Healthcare?

There have been very few changes in the last five years that impact current plans. The Affordable Care Act (ACA) legislation has been slightly tweaked, but otherwise has remained in tact. The major change has been the elimination of the mandate (and required 2.5% penalty) to purchase qualified healthcare coverage. The Trump Administration has indicated that the mandate will not return, although opposition of the reinstatement remains strong. Expansion of Medicare to younger ages is also a possibility.

Additional changes may become effective in 2027. The enhancement of HSA plans, and the re-introduction of cheaper major medical policy options is likely. However, major components of the ACA Legislation will remain, including guaranteed insurability, covered pre-existing conditions, and children allowed to remain on a parent’s policy until age 26. It is also likely that individual states will be provided a bigger role in policy-making, instead of the federal government. 24-month short-term coverage is no longer available, and previously offered an attractive cheap option. It is possible that temporary plans could become less restrictive within the next several years.

More customized high-deductible plans, along with HSA enhancements may also be developed. Additional companies are expected to re-join the Ohio health insurance market. Aetna and UnitedHealthcare, who once offered private individual plans in all counties, may begin offering more Exchange plans in Ohio within the next several years.

Additional carriers, including Humana and Medical Mutual, could possibly increase their service area. Cigna and Kaiser are two additional large carriers that could also consider offering private coverage. It’s also possible that the ACA could be dismantled in favor of a much more affordable and cost-effective option.

Senior Medigap coverage has not been impacted, although three years ago, a new High-Deductible (HD) Supplement plan was introduced (Plan G-HD). The current deductible is slightly higher than $2,870. The monthly cost of coverage in Ohio is approximately $45-$75 per month, depending upon the carrier.

What If I Already Have Coverage?

You are not required to have “qualified” health insurance that meets specific requirements including the inclusion of “essential health benefits.” Previously, if you owned a plan that was issued on or before March 23, 2010, you could probably keep it (if you wish) and would not have to change. This was covered under the “grandfathering of plans” clause. NOTE: Group plans do not qualify for grandfathering benefits. Also, very few grandfathered plans are still active.

Your employer or existing company was able to verify its “grandfather” status. However, you still had the option of purchasing a new Marketplace policy. For example, if quickly obtaining maternity benefits was important, terminating a grandfathered policy might have saved you thousands of dollars since it may not have been covered under the old policy. We search for the option that provides the least amount of out-of-pocket expenses, and best covers maternity, and prenatal costs. Grandfathered plans have now all been replaced.If your existing medical coverage is provided through your own or your spouse’s group plan, a financial subsidy probably will not be available unless your benefits are determined to be “unaffordable.”

If an employer requires their employee to spend more than 8.39% of the total household income on healthcare benefits, the policy is considered “unaffordable.” The determination is based on “self only” coverage, and not the total cost for all family members. Approximately 5 million persons were subject to the “family glitch,” which occurred when the employer pays very little or none of the dependent plan coverage. Non-Obamacare policies are often affordable, but pre-existing conditions are not covered. In 2024, the glitch was revised so fewer families are impacted.

You may also receive correspondence that you have to replace that plan. If you receive a letter or email indicating that the existing policy will terminate, please contact us immediately, so we can review your options, which may include extending the termination date of the contract. Each carrier has the discretion to either continue or terminate private plans. Typically, you are notified in September or October so you have ample time to select a policy effective January 1st. It is not unusual for policies to be replaced by similar plans with very few changes.

Even if preventive benefits (which are mandatory) are not included, it still may qualify as a grandfathered contract. If it is an individual policy, you will have options that allow you to retain coverage. Typically, you are notified of the status. In some situations, you can renew the policy for an extended period of time. However, as new plans are developed and introduced, many older plans are replaced. If you recently retired, it is likely that you do not have a grandfathered plan.

What Companies Are Offering Coverage?

Thirteen carriers offer policies on the Marketplace. Available companies include: Ambetter, Anthem Blue Cross, Aultcare, CareSource, Medical Mutual, Molina, Paramount, Oscar, Antidote, and SummaCare. No carrier offers coverage in all counties, and many companies only offer plans in selected counties (Anthem, Paramount, and Oscar). If you move from one county to another, it is possible you will have to change plans.

Ohio Counties With Most Companies Offering Marketplace Plans

28 counties offer 8 or more carrier options. 21 counties offer 7 or more carrier options and 16 counties offer 6 or more carrier options.

Ohio Counties With Least Companies Offering Marketplace Plans

2 – Knox

3 – Athens

4 – Washington, Meigs, and Lawrence

NOTE: Miami Valley Hospital (pictured below) and its many facilities, are integral to Premier’s Senior provider network. Additional hospitals include Good Samaritan, Atrium Medical, Upper Valley Medical Center, Dayton Children’s, Cincinnati Children’s, and Tri-Health. Premier offers very attractive plans to its employees, but not through the Marketplace or Medigap programs. Premier Virtual Care can treat and evaluate conditions through a video chat. The service is available 24/7. Premier previously offered Exchange coverage in the Buckeye State.

What Are The Cheapest Available Ohio Health Insurance Policies? (2026)

Catastrophic contracts are often the least expensive option, but you must be under age 30 to apply, and they are not eligible for a federal subsidy. However, the plans listed below can be purchased by anyone, and a subsidy will apply (if you meet income requirements). You can also request Off- Exchange quotes from participating carriers.

Medical Mutual Market HMO Young Adult Essentials

Medical Mutual Bronze 8300

Medical Mutual Bronze HSA $7,300

Medical Mutual Bronze Standard

Molina Bronze 8

Molina Bronze 9

Molina Bronze 10

CareSource Bronze First 7500

Anthem Catastrophic Pathway X HMO 9200

Anthem Bronze Pathway X HMO 9200

Anthem Heart Healthy Bronze Pathway X HMO 6000

Anthem Bronze Pathway X HMO 7500 Standard

Anthem Bronze Pathway X HMO 4000

Anthem Bronze Pathway X HMO 7450 for HSA

Ambetter Standard Expanded Bronze

Ambetter Everyday Bronze

Ambetter Choice Bronze HSA

Ambetter Clear Silver

Oscar Secure Select

Oscar Bronze Classic PCP Saver Select

Oscar Bronze Classic – Standard Select

Oscar Bronze Classic 4700 Select

Oscar Silver Simple PCP Saver Select

Paramount Value Bronze HRA

Paramount Economy Bronze HSA

Paramount Standard Expanded Bronze

SummaCare Value with 3 Free PCP Visits

SummaCare Bronze 8000

SummaCare Bronze 9200 with 3 Free PCP Visits

SummaCare Standard Bronze

Aultcare Bronze 7000 Select

UnitedHealthcare Bronze Standard

UnitedHealthcare Bronze Value

UnitedHealthcare Bronze Value+

Antidote Catastrophic Standard

Antidote Bronze Complete

Antidote Bronze Elite

What Are The Most Expensive Available Plans (All Companies) That Offer The Most Comprehensive Coverage?

CareSource Marketplace Gold

CareSource Marketplace Low Deductible Silver

CareSource Marketplace Standard Silver

Medical Mutual Market HMO 2500

Anthem Gold Pathway X HMO 2500

Anthem Silver Pathway X HMO 3200 10 for HSA

Oscar Gold Elite

Oscar Gold Classic

Oscar Gold Classic HSA

Ambetter Secure Care 5

AultCare Silver 5000

AultCare Gold 1000

What New Company Should I Consider?

Oscar offers extremely competitive pricing if you live in one of five Northeastern Ohio counties: Cuyahoga, Medina, Lorain, Summit, and Lake. Additional counties in the Columbus service area include Franklin, Licking, Delaware, and Fairfield. Their joint venture with the Cleveland Clinic offers improved scheduling, patient care, and communication. Additional counties are expected to be added to the network. Oscar also offers very competitively-priced HSA plans. Typically, several physician assistants, and the primary-care doctor, join a team of professionals that manage the healthcare that is provided to the policyholder.

An additional fairly-new company available in the Dayton area, and other counties, is Ambetter (affiliated with Buckeye Health). Their prices are very attractive when compared to other major companies, and several of their policies include dental, vision, or both extra benefits. Often, copays and deductibles are small, especially their Silver-tier contracts. Centene Corporation is the parent company of Ambetter, who operates in several states other than the Buckeye State. Molina is also a carrier with very attractive rates, and also features a network that expands in many additional parts of the US. Molina and Ambetter, however, do not have large provider networks in all of Ohio.

How Do I Apply?

There are several ways to apply for a policy. We provide a direct link (see below) that allows you to answer the questions online. We can assist you with any of the questions and also help calculate your federal subsidy that will lower your rate (if you qualify). Since we are local and experienced, we are more likely to be able to provide you with quick and accurate answers to your questions. And all of the participating companies are available for individual or family protection.

2025 Ohio Health Insurance Marketplace Open Enrollment

The federal website is also available. Prices will be exactly the same, although you will have to navigate through the process with limited assistance. Inexperienced “navigators” are available throughout limited sections of Ohio. However, they may not be licensed and they are also prohibited from making specific plan recommendations. Recently, Cincinnati Children’s Hospital Medical Center, who had previously received federal funding, realized they were ineligible to act as navigators since they negotiate with insurers. In the future, we expect the federally-funded navigator program to be completely eliminated or drastically changed.

This is why we highly encourage you to use our direct link. You get a dual benefit of the lowest prices and live expert advice. And the amount of time required to activate a plan is much lower than the .gov website. You also will be serviced by a local Agency with 42 years of experience, instead of a toll-free phone number located outside of Ohio.

The Subsidy

The subsidy takes the form of an instant tax credit and is based on your household income. For example, a 50 year-old that earns less than $72,000 per year, will receive aid. Of course, for a married couple without children, the amount (about $150,000) is substantially more. Under 400% of the Federal Poverty Level is used as a benchmark. Policies are referred to as “Metal” since the four choices are Platinum, Gold, Silver and Bronze.

The bigger the size of your family, the larger the subsidy. For example, a family of three, including one child (assuming ages in the mid-40s), would receive a subsidy of approximately $840 per month with $50,000 of household income. However, with two additional children (total of three), Medicaid-eligibility is likely. It pays to have a big family under if you qualify for federal aid.. We can calculate your personal subsidy and eligibility in less than a minute. Call or email us any time.

NOTE: If your income is too low, you may have to enroll for a Medicaid plan, since a subsidy would not be offered. When Medicaid requirements expanded to 138% of the Federal Poverty Level, many households suddenly became eligible. For example, a single person (age 40) that earns about $19,000 is eligible. Catastrophic plans are not eligible for instant tax credits.

There Are No Medical Questions. Right?

That is correct. The application asks information regarding where you live, your age, additional dependents, and the type of plan you are applying for. But you will not be asked about your health or any pre-existing condition issues. Your smoking status is the only personal criteria used to determine the rate. Your health, credit, height/weight, and prior conditions have no impact on prices. Also, if you suddenly develop a condition or sustain an injury during the enrollment process, it will not impact your prices or plan options.

NOTE: Temporary plans require medical underwriting, and several questions will be asked. It is possible to be declined for short-term benefits, or not be able to renew a prior plan because of changes in health. Also, pending legislation could impact short-term plan availability in the future.

Is Open Enrollment The Only Time I Can Buy A Policy?

Actually, there are designated “special enrollment periods” when you are also allowed to apply for Ohio Health Marketplace coverage, even if it is outside of the specified time frame earlier mentioned. Assuming you are a qualified individual, some of the events that qualify for these special periods include:

Losing “minimum essential benefits.”

A newly classified citizen.

The result of a permanent move to a new service area.

Gaining a dependent or becoming a dependent through adoption, birth or marriage.

A major violation of your qualified health plan can be proven.

An error by the Exchange causes an individual to erroneously enroll or be terminated from their qualified plan.

You can buy a “short-term” policy (mentioned above) at any time during the year. The premium will be very low since it covers mostly catastrophic events. However, it may not fulfill the requirements of Obamacare and subsequently, a special tax (discussed) will be imposed. Also, the maximum payout will be between $250,000 and $1 million, instead of unlimited benefits. Typically, preventative benefits are not covered at 100%, and non-preferred brand drugs will not be fully covered. Although office visit and prescription drug benefits are available, often, a rider is must be added to utilize benefits.

However, since the policy is typically kept for less than 12 months, these amounts should be sufficient. You can synchronize the beginning of your personal coverage to coincide with the termination of your short-term plan so there is no lapse in benefits. When your policy renews, you will have to medically qualify again. It is anticipated that this type of plan will become more flexible in 2026, with perhaps more companies underwriting the risk.

What Is The Penalty If I Don’t Purchase Coverage?

There is no penalty. Beginning in 2019, it was eliminated.

The penalty was actually a tax, and millions of Americans ignored the new law to pay the tax, despite the risk. In 2014, the tax (or fine) was $95 per adult and half of that amount per child with a family cap of $285. However, if 1% of your family income exceeded the previous calculated amount, than you paid the 1%. For example, if your household income was $70,000, you paid a $700 tax. Because of numerous glitches in the federal website, additional time has been provided to sign up for coverage.

Seven years ago, the tax jumped to $325 per adult and $162.50 for each child with a family maximum of $975. However, the 1% household income calculation doubled to 2%. Thus, a household income of $80,000 resulted in a $1,600 tax. However, $40,000 of income resulted in an $800 tax, which is less than the family maximum when adding penalties individually.

Three years ago, things got dicey. The adult and child charge changed to $695 and $347.50 respectively with a maximum family charge of $2085. The household calculation was 2.5%. So, in the previous example, an $80,000 family income would pay a tax of $2,000 for not purchasing qualified Ohio health insurance coverage. However, if coverage was in effect for a portion of the year, the penalty was reduced accordingly.

Important Note: The IRS has announced it will end the practice of not processing federal tax returns of filers that may not have compliant health insurance. The Trump Administration requested that this action be taken, to soften the financial impact of the Obamacare legislation. Although tax returns will continue to be processed, the penalty for not having coverage is still applicable, and consumers are still required to pay the tax. Only new legislation can eliminate the tax.

Is Single-Payer Universal Healthcare Coming To The US?

Universal healthcare is a system in many countries where all citizens are covered under the same (or very similar) type of policy. Benefits are fairly comprehensive and typically there is no cost to consumers since the government pays for all treatment. The concern of many persons is the quality of treatment and the length of time it takes to receive this treatment. Usually, if you are healthy, you don’t mind this type of delivery system. But if you need treatment, delays are expected. Often, knee replacements, and other non-life-threatening operations can have long waiting periods. Epidemics (COVID) can further strain Universal Healthcare systems.

Increased taxes usually fund this type of medical coverage, and that would not be a popular option here in the US. In some countries, extra money is raised by citizens that wish to purchase additional services. Also, many type of hybrid plans are available that combine aspects of private and government-provided treatment. In Canada, for example, coverage is publicly funded, with each Province administering plan options. All legal citizens automatically qualify.

Our political landscape is hard to predict and the Presidential election results will play a major role in forming the direction of our healthcare. But for now, the combination of private companies and limited government involvement will probably continue for awhile. When Donald Trump defeating Hillary Clinton several elections ago, the chances of a single-payer system being implemented became greatly diminished. The current administration has indicated that expansion of HSAs and cross-state selling are likely to occur. A public option (during Open Enrollment) may become available by 2032.

Does Medicaid Expansion In Ohio Affect Me?

If your household income is less than 138% of the Federal Poverty Level (About $16,000 for an individual and $32,000 for a family), each state has the option to offer Medicaid coverage to those persons. Otherwise, Medicaid is available at the 100% level. Here in the Buckeye state, the topic of expansion has been a very contentious topic and was finally approved.

The new reform law had the support of past-Governor John Kasich. Almost 300,000 persons became eligible. But it could become very costly in later years, which worries many congressmen. Also, the Cleveland Clinic, the biggest Medicaid provider in the state, has eliminated part of its workforce because of anticipated Medicaid cuts. Another variable is that every two years, any previous changes can be voted on again.

NOTE: It is possible that because of a substantial drop in your income, Medicaid eligibility may be available, while in previous years it was not. For example, a reduction in hours at work, a temporary layoff, or early retirement could result in either a larger subsidy, or a low enough household Federal Poverty Level ratio to satisfy Medicaid requirements. 2023 federal subsidies have again increased for single applicants and multiple household applicants.

Please contact us if you have any questions regarding applying for coverage during Open Enrollment, or the Ohio Health Insurance Exchange plans. We make it easy to compare prices. Also, keep in mind that Medicare is different than Medicaid, and their Open Enrollments are different.

PAST UPDATES:

After President Obama’s press conference yesterday, the Dept. Of Insurance announced they will support the continuation of non-grandfathered policies for individuals and small businesses. However, each company can determine which plans will be eligible for this change. This means that many consumers, who may have been forced to terminate contracts because they were not Affordable Care Act-compliant, may be able to keep those plans. Yes….It is confusing.

About 40,000 Ohio consumers have enrolled in the Exchange so far. Although we have helped many customers with the enrollment process, we can’t take credit for all of the 40,000 applicants! About 30,000 persons have been eligible for a subsidy and the most common plan is the “Silver” option because of the lower deductible features.

17 days remain in the Open Enrollment, although consumers can continue to buy coverage after April 1. However, unless a specific exception is granted, a subsidy will not apply to the premium, and key benefits (maternity, for example), may not be included. Nancy Sebelius also visited our state in an attempt to help push final enrollment numbers. With a few weeks left, about 80,000 persons have signed up, which is far below the initial predictions.

The Obama administration has extended the enrollment period by about two weeks for applicants that start the application process but are unable to complete it. There is now a small box (blue) that can be checked that will extend the Open Enrollment. This special period will apply to both online and phone applications and it will allow consumers to avoid the tax that is imposed for not having coverage.

Price projections for effective dates (OE begins November 15th) have been released. Companies are actively submitting their rate increase (and decrease) requests to the Department Of Insurance. UnitedHealthcare will be joining the Marketplace after sitting out last year. Anthem has requested price increases of about 8% (average) on their plans. Bronze policies may not go up as much.

Prices have not been released yet, although we expect to see initial numbers within the next month. For persons that need coverage between now and the end of the year, and you don’t qualify for a “special enrollment exception,” temporary coverage (off-Exchange) is available. Prices are quite low because of benefit restrictions.

Premier Health will offer plans for the Marketplace. Based in Dayton, they will serve Montgomery County and the surrounding area in their first venture. Plan selection will be limited, although both under-65 and Medigap options will be offered. Miami Valley Hospital and its vast network will be part of the provider list.

It’s here! Open Enrollment has arrived. So far, the process is running smoothly. Our direct link allows you to get a free quote, compare, and enroll in 10-20 minutes. If you need help, contact us. Aetna and UnitedHealthcare made it official by offering Exchange plans. UnitedHealthcare has some very competitive prices in many counties.

A list of medical conditions covered by Obamacare is available. Simply submit a written (email is fine) request. Regardless if you have prior coverage, once your enrolled policy is approved, you can use preventive and elective benefits without waiting. January 1 effective dates are still possible.

The deadline for securing a February 1 effective date ended yesterday. Any applications or enrollments submitted between today and February 15th will receive a March 1 effective date. The exceptions are Special Enrollments that allow you to purchase coverage at any time.

The American Lung Association concluded a study that determines that the vast majority of Ohio Marketplace plans do not provide the required tools and benefits that assist consumers to stop smoking. The ACA legislation mandates that carriers provide specific smoking cessation drugs (and counseling) at no cost, subject to certain provisions. The Buckeye State has one of the highest percentage of smokers in the US.

The initial rate filings have been received by the DOI. Most companies will be increasing premiums, although many plans will not see dramatic rises. Listed below are the projected price hikes for several popular policies. The higher prices must be approved before they are actually implemented.

37.6% – Assurant (Time) Individual QHP

19.6% – UnitedHealthcare Off-Exchange

17.8% – Aetna HMO Small Group

17.3% – HealthSpan Individual Plans

16.9% – Medical Mutual Individual Plans

What does Donald Trump’s win mean for Ohio health insurance rates? As previously mentioned, a repeal of Obamacare is probable, but a new replacement will have to be created first. Since this will likely take between 3-9 months, major changes may not be implemented until 2019, although 2018 remains a possibility. Senior MedSup coverage should not be impacted by the Trump win.

Open Enrollment has ended. Will there be another OE period next year? It’s premature to speculate, since although changes will occur, we don’t know the magnitude or timing of these changes.

Although prices increased, higher federal subsidies have resulted in lower premiums for many persons over age 50.

Inexpensive Health Insurance Plans In Ohio Starting At $25 Per Month

Low-cost Ohio health insurance plans are offered through the Marketplace. Medical Mutual, Anthem, Ambetter, Oscar, Paramount, Molina, SummaCare, Aetna, UnitedHealthcare, and CareSource feature budget-friendly policies that are extremely affordable and inexpensive. Premiums for individuals, families, the self-employed or the unemployed will be much cheaper than you realize after viewing some of the plans, and including a federal instant tax credit (subsidy). This reduction often results in many policies with $0 monthly premiums.

We help you apply and enroll for both on and 2026 off-Exchange policies. Medical questions and physicals are not required,and meeting specific underwriting guidelines are not needed. Quality benefits are no longer impossible to obtain, and the ACA subsidy could pay most or all of your premium payments for Ohio Marketplace plans. The instant tax credit is based on your household income, and ages of all applicants. If your spouse is Medicare-eligible, the federal tax credit is still offered. Note: Actual premium can be lower (or higher) than $25, depending upon household income.

You can obtain benefits with many companies, regardless if you have previous coverage, or if a prior policy has lapsed. During the official Open Enrollment election periods, there are no pre-existing condition exclusions, and previously unavailable benefits, such as mental illness and maternity, are included on all Exchange plans. Out-of-pocket costs will vary, and can be quite substantial, unless an upper-tier plan is selected. Deductibles range from $0 to $10,600. However, the policy deductible may not necessarily apply to all office visits and prescriptions.

The best health insurance often contains coverage found in more expensive policies. While catastrophic expenses are covered, additional benefits such as office visits, prescriptions, preventative exams and lab/X-ray costs are also included. Preventive benefits are covered at 100% with no waiting period. Thus, if your policy effective date is January 1, a routine annual physical scheduled for January 2 is completely covered. Complications that result from the annual physical may be subject to a deductible.

Student medical plans are offered by most carriers. Since most students are under age 25, prices are less expensive than the typical adult plan. Preventative benefits are also provided without a copay, coinsurance, or deductible. Since University-provided policies will always cost more than $25 per month, continuing coverage through a parent’s subsidized contract (or employer-provided group plan) is often the only option to keep premiums low. Medicaid may also be available, depending on household income.

Affordable Care Act (ACA) Plans

Healthcare reform changes mandated the preventive benefits coverage along with many additional items including the elimination of lifetime caps on benefits paid. These extra benefits also apply to high-deductible policies (HSAs) and most other contracts. Only short-term, critical illness, limited-benefit, and other unapproved policies do not contain these requirements. Senior Medicare products are not subject to ACA provisions.

Additional “essential benefits” automatically began to be included on all policies eight years ago as part of legislation issued by the Department of Health And Human Services. Maternity and mental illness are two provisions that are covered along with many others. Previously, comprehensive contracts excluded many of these services or placed a waiting period and/or extra deductible on benefits. Policies are also not medically-underwritten, so no medical questions are asked, and a physical is not required for any applicant.

Our “Get Free Quotes” box at the top of this page, allows you to view and compare all available Ohio health insurance plans at the lowest available rates. Also, listed below are some budget-oriented choices with surprisingly comprehensive benefits. Depending on the plan, a copay (only) may apply to primary care physician and,or specialty office visits. “Virtual” office visits often have a $0 or low copay. Urgent Care copays are higher, and sometimes not subject to the policy deductible. ER visits are covered but typically must meet a deductible and coinsurance.

Catastrophic Policies

Market HMO Young Adult Essentials ON-EX (Medical Mutual) – Since this policy is offered in the “catastrophic” Metal tier, unless you’re under 30 or can qualify for a financial hardship exception, it is not available. The plan is ideal for students, professionals or young persons that seek the lowest available premium, and are willing to accept a larger ($9,200) deductible.

A $40 copay for office visits (first three) bypasses the deductible and large negotiated provider discounts help offset the cost of additional non-preventive visits. An optional dental and vision rider is also offered. A children’s eye exam and dental checkup is also included at no charge. The plan is available in many parts of the state.

Value With 3 Free PCP Visits + Adult Vision Care (SummaCare) – If you live in Northeastern Ohio, this policy is another cheap catastrophic option. The deductible of $9,200 is high, although once it has been met, 100% of your expenses are covered without additional coinsurance. The first three pcp office visits are fully-covered.

Note: Since federal subsidies are not offered in the catastrophic tier, premiums are often higher than Bronze and Silver-tier plans.

Bronze Policies

Bronze Pathway X HMO 9200 (Anthem) – $9,200 deductible with 0% coinsurance. The Anthem provider network is countrywide. Virtual (Telehealth) visit benefits are offered.

Bronze Pathway X HMO 6000 (Anthem) – $6,000 deductible with 50% coinsurance. The Anthem provider network is countrywide. $50 copay for first three pcp office visits. Virtual (Telehealth) visit benefits are offered. $20 generic drug copay ($50 mail order).

Bronze Pathway X HMO 7500 (Anthem) – $7,500 deductible with 50% coinsurance. The Anthem provider network is countrywide. $50 and $100 office visit copays. Virtual (Telehealth) visit benefits are offered. $25 generic drug copay ($62.50 mail order). $75 Urgent Care copay.

Standard Expanded Bronze (Ambetter) – Once the $7,500 deductible is met, benefits are paid at 50% up to the maximum out-of-pocket limit. Virtual online office visits are covered with no out-of-pocket expense. Office visit copays are $50 and $100. The preferred generic drug copay is $25 (retail) and $62.50 (mail order). The generic drug copay is also $25 (retail) and $62.50 (mail order). The Urgent Care copay is $75. Buckeye Community Health is the parent company and offers many inexpensive options in this tier. Vision and adult dental for adults can be added to all Ambetter contracts. $9,200 maximum out-of-pocket expenses.

Bronze Classic – PCP Saver Select (Oscar) – $7,750 deductible with 50% coinsurance. $25 pcp office visit copay. $90 specialist office visit copay subject to deductible. Virtual (Telehealth) visit benefits are offered. $3 and $30 generic drug copays (Tiers 1A and 1B). $100 Urgent Care copay. $50 lab work copay subject to deductible.

Bronze Classic Standard (Oscar) – $7,500 deductible with 50% coinsurance. $50 and $100 office visit copays. Virtual (Telehealth) visit benefits are offered. $25 and $62.50 generic drug copays (Tiers 1A and 1B). $75 Urgent Care copay. $50 copay for preferred brand drugs (subject to deductible).

Bronze Classic 4700 Select (Oscar) – $4,700 deductible with 50% coinsurance. $60 and $125 office visit copays. Virtual (Telehealth) visit benefits are offered. $3 and $30 generic drug copays (Tier 1). $125 Urgent Care copay. $70 copay for diagnostic tests.

Bronze Value (UnitedHealthcare) – $8,250 deductible with 40% coinsurance. The UHC provider network is countrywide. Virtual (Telehealth) visit benefits are offered. $5 preferred generic drug copay. $40 pcp office visit copay. $20 lab testing copay at free standing office.

Market HMO 9450 (Medical Mutual) – $9,450 deductible with 0% coinsurance. This policy is ideal if your physicians and hospitals are in the Medical Mutual provider network, and very few non-preventative claims are submitted.

Bronze 2 HSA (Aetna/CVS) – $6,200 deductible with 50% coinsurance. The Aetna provider network is countrywide.

Bronze First 7500 (CareSource) – $7,500 deductible with 50% coinsurance. $50 and $100 office visit copays. Virtual (Telehealth) visit benefits are offered. $25 and $62.50 generic drug copays (Tiers 1A and 1B). $75 Urgent Care copay.

Bronze 8000 (SummaCare) – $8,000 deductible with 50% coinsurance. This policy is ideal if your physicians and hospitals are in the SummaCare provider network, and very few non-preventative claims are submitted.

Silver Policies

(Note: Silver tier plans are the only options that allow you to drastically reduce the deductible through “cost-sharing.” If your household income qualifies, you can easily save thousands of dollars on a major claim, and hundreds of dollars on office visits. Yes…It’s a bit like getting money handed to you through your TV!)

Constant Care Silver 7 250 (Molina) – $0 deductible. $30 pcp office visit copay and $90 specialist office visit copay. Provider network is not as large as many other carriers.

Constant Care Silver 4 250 (Molina) – $7,450 deductible with 0% coinsurance. $30 pcp office visit copay and $65 specialist office visit copay. Preferred generic and preferred brand drugs not subject to a deductible.

Silver Pathway X HMO 6100 0 for HSA (Anthem) – $6,100 deductible with 0% coinsurance. HSA-eligible.

Silver Pathway X HMO 6900/25% (Anthem) – $6,900 deductible with $25 copays on pcp office visits. Low $10 copay for Tier 1A generic drugs. $40 Tier 2 drug copay.

Balanced Care 31 (Ambetter) – $5,450 deductible and 10% coinsurance. $60 Urgent Care copay.

Gold Policies

Confident Care Gold 1 (Molina) – $2,100 deductible and 20% coinsurance. The lowest-cost Gold-tier plan in many counties. $10 and $50 office visit copays with $10 Urgent Care copay. Copay for blood work and x-rays are $15. Generic and preferred brand drug copays are $10 and $50. $8,550 maximum out-of-pocket expenses.

Gold Pathway X HMO 2500 (Anthem) – $2,500 deductible with 20% coinsurance. $25 pcp office visit copay and $45 specialist office visit copay. Tier 1 and Tier 2 drug copays are $10 and $35 (Preferred network). The Urgent Care copay is $75. $8,450 maximum out-of-pocket expenses.

Secure Care 20 (Ambetter) – $750 deductible and 35% coinsurance. $35 and $55 office visit copays with $35 Urgent Care copay. Copay for lab (outpatient) and professional services is $35. Generic and preferred brand drug copays are $5/$15 and $60. $7,500 maximum out-of-pocket expenses.

Senior Medicare Options

To find Medigap plans that cost less than $25 per month, Medicare Advantage plans would need to be considered. Although not all contracts cost less than $25, many policies are offered with $0 premiums. Often, dental, vision, and hearing benefits are provided, along with additional perks, including SilverSneakers or YMCA memberships. Although Supplement plans are more expensive, the network of providers is much more inclusive. Before considering a Supplement or Advantage (MA) plan, the provider network and formulary drug list (if applicable) should be considered.

The highest-rated MA plans in Ohio with the lowest premium are listed below:

AARP Medicare Advantage Plan 1

AARP Medicare Advantage Plan 7

AARP Medicare Advantage Plan 8

Aetna Medicare Value Plan

Anthem MediBlue Service

Humana Cleveland Clinic Preferred

Humana Gold Plus

MedMutual Advantage Access

MedMutual Advantage Signature

MedMutual Advantage Classic

SummaCare Medicare Amber

SummaCare Medicare Topaz

The Health Plan SecureCare Option II

Although many of these low cost policies should always be considered when evaluating affordable options, there are hundreds of additional policies offered by the major carriers, and some may be the best choice for you. That’s where we can help. We’ll research all available plans…not just a few. And if your need is temporary, we’ll consider a “short-term” contract, which allows you to get coverage the next day, and keep for a month, or sometimes as long as 12 months.

Please don’t hesitate to call or contact us with questions. We know Ohio plans better than anybody since we are located here and have 40 years of experience providing help to thousands of clients. And of course, you never pay any fees.

Ohio Short Term Health Insurance – Cheap Temporary Rates

Get the cheapest short-term medical coverage available in Ohio. If you are not working, are a recent high school or college graduate that is no longer covered under a parent’s policy, unemployed, between jobs, a seasonal employee, currently uninsured, laid off, or just waiting for other coverage to begin, then a temporary policy might be your best option. It’s fast and flexible. Most plans have large doctor networks and easy online enrollment and are ideal if benefits are only needed for a short period of time. Applicants can choose their length of coverage, deductible, and other available benefits. Coverage can be purchased for one month or up to four months (with renewal).

The quotes you view on our website are the lowest available rates allowed by each carrier. Most options will easily fit within your budget, because of the heavily-discounted premiums. The length of benefit you choose is also extremely flexible. Generally, you can choose a policy that lasts from 30-364 days, although some features are limited, and you can be denied because of your medical history. Multiple-year extensions are offered with several carriers to help avoid gaps in coverage. Provider networks must be disclosed by the carrier to applicants. The Aetna, Cigna, and Anthem networks are offered in the Buckeye State.

Also, if you are employed part-time or temporarily laid off, on strike, or on Cobra, you may need this type of plan. ST health insurance is extremely cheap and is available from the top insurers such as UnitedHealthcare, Anthem, Medical Mutual, Allstate, Paramount, Companion Life, and several smaller companies including Medical Mutual and Everest. Your rights under HIPAA may be impacted if you are changing jobs, although Marketplace plans would become available. Lapses in permanent coverage are effectively covered by temporary plans.

If a chronic health condition develops, an Exchange plans should be considered during the next Open Enrollment period. Pre-existing conditions will be covered and qualified preventative expenses will have no out-of-pocket costs. Generally, applicants under age 65 can not apply for coverage, and no medical questions are asked. Legal state and US citizenship is a requirement.

During the under-65 Open Enrollment period (November 1-January 15th), a Marketplace plan should always be considered, especially if you qualify for a federal subsidy or are being treated for a serious medical condition. If you are eligible for COBRA, you may be able to purchase a Marketplace plan outside of the Open Enrollment period (SEP), and pre-existing conditions will be covered. By selecting an alternative plan to COBRA, guaranteed coverage may not be offered until the next Open Enrollment period.

Approved 2025 Changes

Approved and implemented, Congress and the Center For Medicare And Medicaid Services changed the structure of short-term health insurance plans. New rules now limit short-term plan initial coverage periods to a maximum of three months. Renewable plans are available, but with a maximum duration of four months, including the renewal. And a policy is not offered to the applicant if they have purchased a temporary policy within the last 12 months from that carrier. The limited duration was approved by CMS.Gov.

Anthem And UnitedHealthcare Are Available, But Cigna And Humana No Longer Offer Temporary Plans

Humana, one of the nation’s largest carriers, ceased offering temporary plans five years ago. Although they actively participate in offering many affordable Senior and Group policy options, their focus has shifted away from private single and family plans for persons under age 65. Their 6450 Dayton HMOx and 6450 Cincinnati/Northern KY HMOx contracts were two of the most affordable Marketplace plans offered in the Southwestern portion of the state. Humana offers Senior Medicare products and many additional ancillary plans.

Cigna also offers Medicare plans in the Buckeye State, but does not underwrite private medical coverage. Anthem offers marketplace plans (subsidized and unsubsidized) in selected counties, along with Medicare Advantage, Supplement, and Part D prescription drug plans. Anthem began offering temporary coverage four years ago. Their plans cover some pre-existing conditions. Medical Mutual offers a limited portfolio of ST plans, with easy online enrollment. Note: Cigna’s network is available when utilizing Allstate’s ST plan. Allstate continues to offer competitively-priced temporary options.

Who Is Eligible For Short-Term Health Insurance?

Applicants must be under the age of 65 and able to qualify medically for coverage. Although several medical questions are asked, a physical is not required. If pre-existing conditions are present, a copy of the medical records may be requested, which is paid by the insurer. If any applicant is currently covered under another qualified plan, that plan must be terminated on or before the effective date of the short-term plan. Also, any person listed on the new application must be a legal resident of Ohio and a legal resident of the United States.

Although a Medicaid-eligible applicant can be approved, generally, a temporary plan will provide lower benefits at a higher cost. Also, CHIP-eligible applicants may also apply for coverage, but is not advisable, since CHIP benefits are comprehensive and the cost of coverage is low. CHIP and Marketplace eligibility have expanded due to increased federal subsidies. It is also possible to decline CHIP or federal subsidies, but enroll in a Marketplace plan.

Sample Ohio Short-Term Health Insurance Rates

Prices of temporary coverage are determined by your age, gender, zip code, health status, duration of policy, and covered benefits. Shown below are monthly rates for several individual and family scenarios in the Buckeye State. Plans are considered “non-Obamacare” policies and are not required to include all ACA Legislation requirements. Plans can be purchased at any time, and although coverage is medically-underwritten, physicals are not required.

30-Year-Old Male Montgomery County

$69 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$71 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$76 – UnitedHealthcare $15,000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$80 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$81 – Everest $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$84 – Everest $10,000 deductible and 0% coinsurance. $1.5 million Policy Maximum. $50 pcp and specialist office visit copays.

$87 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$94 – Everest $2,500 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$98 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$102 – Everest $5,000 deductible and 0% coinsurance. $1.5 million Policy Maximum. $50 pcp and specialist office visit copays.

30-Year-Old Married Couple Montgomery County

$110 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$115 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$127 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$130 – UnitedHealthcare $15,000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$135 – Everest $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$141 – Everest $10,000 deductible and 0% coinsurance. $1.5 million Policy Maximum. $50 pcp and specialist office visit copays.

$147 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$160 – Everest $2,500 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$168 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$175 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

40-Year-Old Male Franklin County

$90 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$92 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$93 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$92 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$102 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$108 – Everest $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$116 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$123 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

$127 – Everest $2,500 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$136 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$138 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

40-Year-Old Married Couple Franklin County

$159 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$162 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$169 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$187 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$194 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$200 – Everest $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$218 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$228 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

$239 – Everest $2,500 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$250 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$263 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

50-Year-Old Female Hamilton County

$133 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$150 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$159 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$161 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$166 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$179 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$182 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$211 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$245 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$262 – Pivot Health $2,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$289 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

50-Year-Old Married Couple Hamilton County

$237 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$270 – Pivot Health $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$291 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$295 – Everest $10,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$309 – Everest $10,000 deductible and 20% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$311 – UnitedHealthcare $15,000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$326 – Pivot Health $5,000 deductible and 20% coinsurance. $1 million Policy Maximum. $30 and $60 pcp and specialist office visit copays.

$341 – Everest $5,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$398 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$406 – UnitedHealthcare $7,5000 deductible and 30% coinsurance. $1 million Policy Maximum. PPO network.

$431 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

$482 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

60-Year-Old Male Cuyahoga County

$195 – UnitedHealthcare $15,000 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$245 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

$245 – Companion Life $10,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$254 – UnitedHealthcare $7,500 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$299 – Companion Life $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$326 – UnitedHealthcare $5,000 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$405 – UnitedHealthcare $2,500 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$481 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$517 – Companion Life $2,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$583 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

60-Year-Old Married Couple Cuyahoga County

$304 – UnitedHealthcare $15,000 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$399 – UnitedHealthcare $7,500 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$447 – Companion Life $10,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$486 – Allstate $10,000 deductible and 0% coinsurance. $1 million Policy Maximum. PPO network.

$513 – UnitedHealthcare $5,000 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$553 – Companion Life $5,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$639 – UnitedHealthcare $2,500 deductible and 30% coinsurance. $2 million Policy Maximum. PPO network.

$847 – Everest $2,500 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

$971 – Companion Life $2,000 deductible and 20% coinsurance. $1 million Policy Maximum.

$1,029 – Everest $1,000 deductible and 50% coinsurance. $1 million Policy Maximum. $50 pcp and specialist office visit copays.

Cheap Short-Term Health Ohio Insurance Rates From Companion Life

Monthly rates below are for plans that guarantee coverage for 12 months.

25-Year-Old Male Licking County

$79 – $10,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$93 – $5,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$117 – $2,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

35-Year-Old Female Wood County

$84 – $10,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$99 – $5,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$162 – $2,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

45-Year-Old Male Lucas County

$111 – $10,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$134 – $5,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$222 – $2,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

55-Year-Old Female Miami County

$172 – $10,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$210 – $5,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$360 – $2,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

60-Year-Old Male Butler County

$243 – $10,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$299 – $5,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

$517 – $2,000 deductible and 20% coinsurance. $1 million policy maximum. Three pcp and specialist office visits covered with $30 and $60 copays.

Temporary policies feature rates that are often cost just a fraction of the cost of a conventional policy. Typically, you’ll save hundreds (or thousands) of dollars in premium savings. You must be under age 65 to qualify, and we custom-fit a policy that covers you for the time you need and keeps the premium low. Plans are also offered for less than 30 days.

If you have reached age 65, you are likely eligible for Medicare benefits, which are much more comprehensive. A Medigap or “Advantage” plan can pay some of the out-of-pocket gaps that your Senior policy does not cover. However, unlike temporary plans, pre-existing conditions are covered, and policies can generally be renewed. If a Supplement plan is purchased, a separate Part D prescription drug plan should also be considered. Most Medicare Advantage plans (MA) include these benefits. Dental, vision, and hearing coverage are also covered on many MA plans.

Did You Miss Open Enrollment?

If you missed Open Enrollment, often, short-term contracts are the most attractive choice to get you to the next OE period. You don’t have to wait until the first of the month to get covered, and approvals are often received within one day. And if you secure new group coverage from an employer or other qualified benefits, you can terminate a temporary plan to coincide when your new policy begins. Typically, there is no cancellation penalty, although you may have to pay for an entire month.