Medicare prescription drug benefits are available to qualified Ohio residents. 2024 Part D plans provide comprehensive coverage from a wide selection of carriers. To enroll in a Medicare drug plan, you must have Part A (Hospital Insurance) and Part B (Medical Insurance). If you delay enrolling for coverage, it is possible that you may incur a late-enrollment penalty without other credible coverage. Although coverage is optional, it is highly-recommended you enroll since the need for prescriptions can quickly change. Even if you are not currently prescribed medications, coverage should still be secured. Both brand-mane and generic drugs are covered.

Before enrolling in a PDP plan, Buckeye State consumers should consider any other prescription benefits they have or are eligible for. Many Advantage plans offer prescription drug benefits, eliminating the need to purchase a separate stand-alone policy. Parts A and B are required for an MA plan. Medical Savings Accounts (MSAs), some employer-provided plans, and private fee-for-service plans generally do not offer these benefits. Depending on the plan, a deductible may apply before benefits are paid. However, there are also $0 deductible options offered.

Several plans now offer substantial savings for insulin. At least one pen and dial dosage forms are offered for the different types of models. Enrollees receiving LIS (low-income cost-sharing subsidy) are not eligible for the supply copayment.Several plans offer costs less than $35. The policy deductible would apply to all other tiers, but not insulin. Medicare Supplement Plans in Ohio do not include drug coverage, so a separate plan must be purchased. Many deductible and benefit choices are offered.

Medicare Part D Plan Coverage

All plans are required to cover specific drugs. Often, these drugs are used for treating serious or terminal diseases and conditions. “Formulary” lists are provided by all carriers, and the listing of all tiers is disclosed. Generic and brand-name drugs are included, along with specialty drugs, which typically are the most expensive. Most formulary lists include two (or more) drugs that are in the most popular classes and prescribed categories. Throughout the year, there my be changes to the formulary list for several reasons, including newer drugs that have become available.

Drugs can also be removed from the list if the Food And Drug Administration decides the drugs are unsafe, or they are no longer offered by the manufacturer. Also, generic drug designations may replace brand name drug designations, resulting in lower out-of-pocket costs for consumers. If changes occur with a prescription you are actively taking, 30 days written notice will be provided at that time or when you refill the prescription. You can request an exception, although utilizing formulary drugs is typically the most economical option.

When initially using your plan, your Medicare card should be carried with you. It will show your name, ID number, and the date coverage began. An automatic refill service may deliver prescribed drugs to your home or business. Your contact information will need to have been previously required for verification. Also, a Medicare drug plan can be joined without forfeiting current coverage if you’re in a cost plan, fee-for-service plan (private), MSA plan, or some job-sponsored Medicare health plans.

Note: Usage of generic drugs can substantially reduce copays, regardless of which Part D you are enrolled in. As copies of brand name drugs, similarities include intended usage, quality of drug, strength, safety, prescribed dosage, and characteristics of performance. Identical active ingredients are used and FDA research and approval is always required.

2024 Defined Standard Benefits

Deductible – $545. After the deductible is paid, 25% of covered costs (to Initial Coverage Limit) are paid by the beneficiary.

Initial Coverage Limit – $5,030 (Up from $4,660). Donut Hole starts when cost of retail drug exceeds the value.

Out-Of-Pocket Threshold – $8,000. All out-of-pocket costs including the donut hole.

Total Covered Spending (Including Coverage Gap) – $11,477.39. Catastrophic benefits start when this amount is reached.

Estimated Part D spending when eligible for coverage gap discount programs – $12,447.11.

Minimum cost-sharing (catastrophic coverage benefit) amounts are no longer relevant since cost-sharing for covered Part D drugs for beneficiaries in the catastrophic phase.

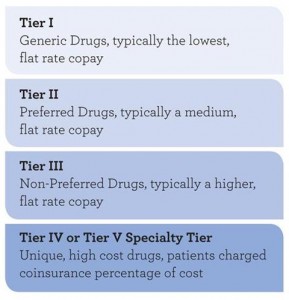

Part D Drug List Tiers

Formularies often list their drugs in “tier” classifications. Generally, drugs in lower tiers cost less than drugs in higher tiers. Although carrier tiers can differ in cost and components, generally, the four available tiers are:

Tier 1 – Generic drugs. This tier offers the lowest copays for consumers. They are often classified as “preferred,” since they tend to be very effective at treatment, and are also the least expensive option. Tier 1 drugs are typically divided into two separate tiers (below).

Tier 1A – Preferred generic drugs. Popular generic substitutes for brand name drugs that often are used in the treatment of chronic diseases. This group has the lowest generic copay.

Tier 1B – All other generic drugs. This group has the largest generic copay.

Tier 2 – Preferred brand drugs that do not have a generic substitute. Copays are higher than Tier 1 drugs.

Tier 3 – Non-preferred brand drugs. This tier includes brand-name (non-preferred) drugs that have no generic substitute alternative. Often these drugs are not included in benefits or have expensive copays.

Tier 4 – Preferred Specialty. Brand-name and specialty drugs are found in this tier. Typically, serious and chronic health conditions are treated with the medications. They are also less costly than Tier 5 drugs.

Tier 5 – Nonpreferred Specialty. The most expensive option and often not covered by insurers. More cost-effective and inexpensive options are typically offered in other tiers.

Note: A “PA” designation signifies that prior authorization may be required to purchase the medication. A “QL” designation means that their may be a limitation on the amount distributed.

Plan Rules

Hospital Outpatient – Drugs received from the ER and observation services may not be covered by Medicare Part B. Common examples are self-administered drugs. A claim may be needed to obtain a refund. of the money you paid.

Step Therapy – Prior authorization is often needed since an effective and less-expensive option may be available. A generic drug may be initially recommended, followed by a lower-cost brand-name drug. In some situations, the more expensive option may be the most effective treatment for a specific ailment. An exception can also be requested if an adverse reaction can occur with a generic drug.

Opioid Pain Medication – A safety review may be performed to verify the dosage is correct or other potentially-harmful drug interactions are avoided. A 7-day supply may be the maximum dosage initially allowed. A drug management program may be offered to provide additional safety measures since very serious health risks can result from misuse.

Part D Vaccines – Commercially-offered vaccines are required to be covered when determined to be “medically necessary.”

Quantity Limits – Often, the amount and timing of dosages are limited to protect the consumer. However, your physician can request that the plan make an exception.

Prior Authorization – Specific prescriptions may require you to contact the plan for authorization to verify it is medically-necessary. Often, a medication is approved for specific conditions, but not other related conditions.

Note: If your policy drug plan card has not been issued yet, Alternative proof options may be utilized. A welcome or acknowledgement letter will be accepted along with a copy of your Medicare card. Also, the plan phone number, name, and conformation number will be accepted.

Ohio 2024 PDP Plan Details

21 plans are available, which is a decrease of three from last year. 13 Enhanced alternative (EA) options are offered in the Buckeye State. EA plans have a value which exceeds the defined standard coverage. Supplemental benefits sometimes include a reduction in copays or coinsurance (initial coverage phase), reduction of the initial deductible, and a reduction of cost-sharing in the initial coverage gap. Nine additional plans (Basic alternative, Defined standard, and an actuarial equivalent) are also offered.

Three $0 Deductible plans can be purchased. They are AARP MedicareRx Preferred, WellCare Medicare Rx Value Plus, and Anthem MediBlue Rx Plus. The monthly premiums for those three plans are $99.80, $78.90, and $102.20 respectively. Five plans are available with premiums less than $25. Monthly premiums for these plans range from $0 (Wellcare Value Script) to $24.10 (Mutual Of Omaha Rx Essential). The most expensive plan is the Humana Premier Rx Plan which costs $108.80 per month.

The average cost of all policies is $59.03 per month, and five plans offer gap coverage in the donut hole. The least expensive of these five plans is Humana Walmart Value Rx ($40 per month).

Two Part D plans in Ohio had rate decreases, and 19 plans had rate increases. Approximately 72% of all policy owners had policy rate increases, and the average amount was $11.62. The LIS Benchmark premium is $40.87 per month, and two plans are LIS-qualified (WellCare Classic and Clear Spring Health Value Rx). The most popular Ohio Part D plans are Wellcare Value Script, SilverScript Smart Saver, SilverScript Choice, AARP Medicare Rx Preferred from UHC, Humana Walmart Value Rx Plan,Wellcare Classic, AARP Medicare Rx Walgreens from UHC, and Humana Premier Rx Plan.

AARP MedicareRx Walgreens from UHC – $54.20 per month and $350 deductible. No additional gap coverage. 3,253 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $2, $8, $40, 50%, and 27%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $6, $24, $120, 50%, and n/a. 28,618 enrolled members reside in Ohio. 856,056 enrolled members reside in the US. The Plan Summary Star Rating is 3.0. The Plan ID is S5921-395. The number of available drugs in each tier is 245 (Tier 1), 488 (Tier 2), 788 (Tier 3), 1,119 (Tier 4), and 630 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

AARP Medicare Rx Saver from UHC – $63.80 per month and $545 deductible. No additional gap coverage. 3,040 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $11, $18, $47, 47%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $33, $54, $141, 47%, and n/a. 16,202 enrolled members reside in Ohio. 766,415 enrolled members reside in the US. The Plan Summary Star Rating is 3.0. The Plan ID is S5921-359. The number of available drugs in each tier is 54 (Tier 1), 451 (Tier 2), 829 (Tier 3), 1,114 (Tier 4), and 608 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

AARP Medicare Rx Preferred from UHC – $99.80 per month and $0 deductible. No additional gap coverage available. 3,640 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $7, $12, $47, 40%, and 33%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $21, $36, $141, 40%, and n/a. 53,838 enrolled members reside in Ohio. 1,375,327 enrolled members reside in the US. The Plan Summary Star Rating is 3.5. The Plan ID is S5820-013. The number of available drugs in each tier is 157 (Tier 1), 723 (Tier 2), 1,013 (Tier 3), 1,064 (Tier 4), and 683 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Anthem MediBlue Rx Standard – $66.80 per month and $545 deductible. No additional gap coverage. 2,919 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $4, 19%, 39%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $12, 19%, 39%, and n/a. 5,165 enrolled members reside in Ohio. 36,485 enrolled members reside in the US. The Plan Summary Star Rating is 3.0. The Plan ID is S5596-013. The number of available drugs in each tier is 59 (Tier 1), 384 (Tier 2), 1,093 (Tier 3), 939 (Tier 4), and 453 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Anthem MediBlue Rx Plus – $102.20 per month and $0 deductible. No additional gap coverage. 3,199 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $4, $47, 50%, and 33%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $12, $141, 50%, and n/a. 13,085 enrolled members reside in Ohio. 88,432 enrolled members reside in the US. The Plan Summary Star Rating is 3.0. The Plan ID is S5596-014. The number of available drugs in each tier is 142 (Tier 1), 469 (Tier 2), 1,062 (Tier 3), 1,073 (Tier 4), and 464 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Cigna Secure Rx – $55.70 per month and $545 deductible. No additional gap coverage. 3,139 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $3, 16%, 43%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $9, 16%, 43%, and n/a. 5,778 enrolled members reside in Ohio. 840,219 enrolled members reside in the US. The Plan Summary Star Rating is 2.5. The Plan ID is S5617-068. The number of available drugs in each tier is 145 (Tier 1), 541 (Tier 2), 664 (Tier 3), 1,295 (Tier 4), and 530 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Cigna Saver Rx – $19.20 per month and $545 deductible. No additional gap coverage. 3,268 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $6, 19%, 49%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $18, 19%, 49%, and n/a. 9,705 enrolled members reside in Ohio. 280,130 enrolled members reside in the US. The Plan Summary Star Rating is 2.5. The Plan ID is S5617-293. The number of available drugs in each tier is 237 (Tier 1), 419 (Tier 2), 1,032 (Tier 3),1,092 (Tier 4), and 520 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Cigna Extra Rx – $79.20 per month and $145 deductible. Additional gap coverage available. 3,356 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $12, 20%, 50%, and 31%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $9, $36, 20%, 50%, and n/a. 13,838 enrolled members reside in Ohio. 259,251 enrolled members reside in the US. The Plan Summary Star Rating is 2.5. The Plan ID is S5617-259. The number of available drugs in each tier is 178 (Tier 1), 585 (Tier 2), 843 (Tier 3), 1,234 (Tier 4), and 547 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Clear Spring Health Premier Rx – $19.50 per month and $505 deductible. No additional gap coverage. 3,169 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $5, $42, 45%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $15, $126, 45%, and 25%. 2,704 enrolled members reside in Ohio. 119,646 enrolled members reside in the US. The Plan ID is S6946-040. The number of available drugs in each tier is 215 (Tier 1), 502 (Tier 2), 795 (Tier 3), 1,076 (Tier 4), and 581 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Clear Spring Health Value Rx – $23.30 per month and $505 deductible. No additional gap coverage. 3,125 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $3, $42, 35%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $9, $126, 35%, and 25%. 360 enrolled members reside in Ohio. 201,352 enrolled members reside in the US. The Plan ID is S6946-011. The number of available drugs in each tier is 196 (Tier 1), 534 (Tier 2), 585 (Tier 3), 1,242 (Tier 4), and 568 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Elixir RxPlus – $64.90 per month and $505 deductible. No additional gap coverage. 3,074 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $6, $43, 47%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $18, $129, 47%, and n/a. Plan Summary Star Rating is 2.5. The Plan ID is S7694-132. The number of available drugs in each tier is 99 (Tier 1), 605 (Tier 2), 588 (Tier 3), 1,186 (Tier 4), and 596 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Elixir RxSecure – $43.10 per month and $505 deductible. No additional gap coverage. 2,989 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $4, 15%, 31%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $12, 15%, 31%, and n/a. 69,302 enrolled members reside in Ohio. 444,496 enrolled members reside in the US. Plan Summary Star Rating is 2.5. The Plan ID is S7694-014. The number of available drugs in each tier is 99 (Tier 1), 594 (Tier 2), 567 (Tier 3), 1,152 (Tier 4), and 577 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Humana Walmart Value Rx Plan – $30.50 per month and $505 deductible. No additional gap coverage available. 3,178 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $2, 18%, 42%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $6, 18%, 42%, and n/a. 50,556 enrolled members reside in Ohio. 1,338,693 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S5884-193. The number of available drugs in each tier is 157 (Tier 1), 667 (Tier 2), 721 (Tier 3), 1,059 (Tier 4), and 574 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Humana Premier Rx Plan – $88.30 per month and $500 deductible. No additional gap coverage available. 3,244 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $4, $45, 37%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $12, $135, 37%, and n/a. 30,576 enrolled members reside in Ohio. 872,688 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S5884-160. The number of available drugs in each tier is 277 (Tier 1), 556 (Tier 2), 763 (Tier 3), 1,073 (Tier 4), and 575 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Humana Basic Rx Plan – $50.60 per month and $505 deductible. No additional gap coverage available. 3,135 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $1, 22%, 49%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $3, 22%, 49%, and n/a. 11,473 enrolled members reside in Ohio. 1,206,799 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S5884-137. The number of available drugs in each tier is 145 (Tier 1), 638 (Tier 2), 756 (Tier 3), 1,032 (Tier 4), and 564 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Mutual Of Omaha Rx Essential – $18.30 per month and $505 deductible. No additional gap coverage available. 3,169 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $15, 20%, 48%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $45, 20%, n/a, and n/a. 1,746 enrolled members reside in Ohio. 29,457 enrolled members reside in the US. Plan Summary Star Rating is 2.0. The Plan ID is S7126-116. The number of available drugs in each tier is 158 (Tier 1), 749 (Tier 2), 739 (Tier 3), 945 (Tier 4), and 578 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Mutual Of Omaha Rx Plus – $79.80 per month and $505 deductible. No additional gap coverage available. 3,125 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $5, 20%, 39%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $15, 20%, n/a, and n/a. 574 enrolled members reside in Ohio. 15,840 enrolled members reside in the US. Plan Summary Star Rating is 2.0. The Plan ID is S7126-013. The number of available drugs in each tier is 158 (Tier 1), 763 (Tier 2), 718 (Tier 3), 916 (Tier 4), and 570 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

Mutual Of Omaha Rx Premier – $73.70 per month and $505 deductible. No additional gap coverage available. 3,032 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $1, $10, $45, 45%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $3, $30, $135, n/a, and n/a. 1,703 enrolled members reside in Ohio. 42,953 enrolled members reside in the US. Plan Summary Star Rating is 2.0. The Plan ID is S7126-083. The number of available drugs in each tier is 137 (Tier 1), 581 (Tier 2), 702 (Tier 3), 1,102 (Tier 4), and 507 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

SilverScript Plus – $73.60 per month and $0 deductible. Additional additional gap coverage available. 3,595 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $0, $47, 50%, and 33%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $0, $141, 50%, and n/a. 16,806 enrolled members reside in Ohio. 400,896 enrolled members reside in the US. Plan Summary Star Rating is 3.5. The Plan ID is S5601-029. The number of available drugs in each tier is 250 (Tier 1), 1,209 (Tier 2), 317 (Tier 3), 1,247 (Tier 4), and 582 (Tier 5). Select insulin copay is $35. Insulin formulary monthly copay is less than $35 per month.

SilverScript Choice – $32.90 per month and $505 deductible. No additional additional gap coverage available. 3,509 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $2, $7, 17%, 44%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $6, $21, 17%, 44%, and n/a. 87,914 enrolled members reside in Ohio. 2,876,329 enrolled members reside in the US. Plan Summary Star Rating is 3.5. The Plan ID is S5601-028. The number of available drugs in each tier is 250 (Tier 1), 1,203 (Tier 2), 248 (Tier 3), 1,253 (Tier 4), and 560 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

SilverScript SmartSaver – $5.10 per month and $505 deductible. No additional additional gap coverage available. 3,677 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $2, $15, 25%, 50%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $6, $45, 25%, 50%, and n/a. 83,769 enrolled members reside in Ohio. 1,514,552 enrolled members reside in the US. Plan Summary Star Rating is 3.5. The Plan ID is S5601-189. The number of available drugs in each tier is 250 (Tier 1), 1,175 (Tier 2), 234 (Tier 3), 1,415 (Tier 4), and 603 (Tier 5). Insulin formulary monthly copay is less than $35 per month.

WellCare Medicare Rx Value Plus – $71.30 per month and $0 deductible. No additional additional gap coverage available. 3,458 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $4, $47, 50%, and 33%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $12, $141, 50%, and n/a. 21,328 enrolled members reside in Ohio. 424,283 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S5768-137. The number of available drugs in each tier is 343 (Tier 1), 383 (Tier 2), 1,037 (Tier 3), 990 (Tier 4), and 661 (tier 5). Select insulin copay is $35.

WellCare Classic – $32.60 per month and $505 deductible. No additional additional gap coverage available. 3,088 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $6, $30, 37%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $18, $90, 30%, and n/a. 52,203 enrolled members reside in Ohio. 1,406,152 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S4802-085. The number of available drugs in each tier is 129 (Tier 1), 421 (Tier 2), 1,059 (Tier 3), 893 (Tier 4), and 586 (tier 5). Select insulin copay is $35.

WellCare Value Script – $11.20 per month and $505 deductible. No additional additional gap coverage available. 3,446 formulary drugs available. 30-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $5, $44, 47%, and 25%. 90-day preferred generic, generic, preferred brand, non-preferred, and specialty drug copays are $0, $15, $132, 47%, and n/a. 135,017 enrolled members reside in Ohio. 2,681,923 enrolled members reside in the US. Plan Summary Star Rating is 3.0. The Plan ID is S4802-149. The number of available drugs in each tier is 322 (Tier 1), 398 (Tier 2), 1,012 (Tier 3), 1,029 (Tier 4), and 661 (tier 5). Select insulin copay is $35.