Ohio Health Insurance Companies – Compare And Shop All Plans

Ohio health insurance companies offer affordable medical coverage through the State Exchange and Marketplace. We research and find individual, family and small business coverage plans at their lowest cost, explain the coverage, and make it easy to purchase the policy that maximizes your subsidy and benefits, and complies with ACA legislation.

For applicants that have reached age 65 and are eligible for Medicare, many affordable Senior Supplement and Advantage plans can reduce potential out-of-pocket expenses. Prescription drug benefits for all tiers are also available through Part D plans. A high-deductible Supplement option (existing Plan F-HD and newer Plan G-HD) offers the lowest cost for Medigap plans.

Non-Obamacare plans are also very popular because of their attractive cost, simplified medical underwriting, personalized benefits, and all-year availability. Rates are typically low, and policies are quickly approved. Up to $2 million of benefits are available, with office visit, prescription, and major medical benefits included.

Urgent Care and virtual doctor visits are typically included with just a copay. Prescription drug, dental, and vision riders can be easily added. Policies will guarantee coverage up to 36 months without additional underwriting. National PPO networks are available along with indemnity products.

We study deductibles and out-of-pocket expenses to help you compare plans, easily enroll, and get the lowest rates. Shopping for coverage through the federally facilitated marketplace can be challenging and confusing for many persons. With our experience and expertise, we make it easy to view the best choices to meet your specific medical and budget needs.

2022 Companies

The carriers writing healthcare business (persons under age 65) in the Buckeye State are Anthem Blue Cross, Ambetter (Buckeye Health Plan), Aultcare, CareSource, Medical Mutual, Molina, Paramount, Oscar, and SummaCare. Individual health insurance in Ohio is widely available.

The two newest carriers are Oscar and Ambetter. Oscar currently offers business in Ohio and 13 additional states. Private under-65 plans are offered, but not Senior products. The Cleveland Clinic is a network facility. Ambetter issues policies in many more Buckeye State counties. Plans are available through Buckeye Health Plan, and their Silver-tier rates are very affordable in many counties. Centene Corporation is the parent company.

American Community Mutual stopped writing business in the state many years ago. Other notable carriers, such as HealthSpan, Premier, Assurant, and InHealth, previously offered personal coverage through the Marketplace. But excessive claims forced these companies to cease operations, and terminate all existing policies. UnitedHealthcare, Humana, and Aetna have also discontinued offering Obamacare subsidized plans, although they may return in several years.

Marketplace Plans Available In Largest Ohio Counties

Cuyahoga – Ambetter, Anthem, CareSource, Medical Mutual, Molina, and Oscar

Franklin – Ambetter, Anthem, CareSource, Medical Mutual, Molina, and Oscar

Hamilton – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Summit – Ambetter, Anthem, CareSource, Medical Mutual, SummaCare, and Oscar

Montgomery – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Stark – Anthem, Aultcare, Ambetter, CareSource, Medical Mutual, Molina, Oscar, and SummaCare

Butler – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Lorain – Ambetter, Anthem, CareSource, Medical Mutual, Molina, and Oscar

Mahoning – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Lake – Ambetter, Anthem, CareSource, Medical Mutual, Molina, and Oscar

Trumbull – Ambetter, CareSource, Anthem, Medical Mutual, and Molina.

Clermont – Ambetter, CareSource, Medical Mutual, and Molina

Delaware – Ambetter, Anthem, CareSource, Medical Mutual, and Oscar

Medina – Ambetter, CareSource, Medical Mutual, Oscar, and SummaCare.

Licking – Anthem, CareSource, Medical Mutual, Molina, and Oscar

Greene – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Portage – Ambetter, CareSource, Medical Mutual, Oscar, and SummaCare

Fairfield – Ambetter, Anthem, CareSource, Medical Mutual, Molina, and Oscar

Clark – Ambetter, Anthem, CareSource, Medical Mutual, and Molina

Wood – Ambetter, Anthem, CareSource,Medical Mutual, Molina, and Paramount

Ohio Companies Offering Senior Medicare Supplement And Advantage Plans

If you have reached age 65, and are eligible for Medicare Parts A and B, instead of a Marketplace plan, you can choose to supplement your Government benefits with a Medigap plan. All carriers in the Buckeye State must be reviewed and approved by the Ohio Department of Insurance. We have listed below many of the popular companies that offer Medicare Supplement and Advantage products. This is only a partial list.

Supplement

AARP (underwritten by UnitedHealthcare)

Aetna

American Republic

American Retirement Life

Americo

Anthem BCBS

Assured Life

AultCare

Bankers Fidelity

Cigna

Colonial Penn

Combined Insurance

Equitable

Everence

Everest Reinsurance

Gerber

Globe Life

Governmental Personnel

Greek Catholic Union

Humana

Liberty National Life

Manhattan Life

Medical Mutual

Mutual Of Omaha

Paramount

Pekin Life

Philadelphia American

Physicians Mutual

Shenandoah Life

Standard Life And Accident

State Farm

SummaCare

Thrivent

United American

USAA

Advantage

AARP – UnitedHealthcare

Advantra

Allwell

Anthem BCBS

Aetna

Bright

Buckeye Health Plan

CareSource

Gateway

Humana

Medical Mutual

MediGold

MeridianCare

Molina

Paramount

Prime Time Health

Provider Partners Health

SummaCare

The Health Plan

UnitedHealthcare

Valor Health

Keeping Current

We are constantly monitoring companies for rate trends and claims-paying ability, and we always share that information with you upon request. We also provide ratings information from independent resources such as A.M.Best Company, Standard & Poors, Moody’s, and Weiss research. The Department of Insurance also provides free online resources that allow us to publish the most recent rate increase (and decrease) requests, complaint ratios of most carriers, and detailed financial data regarding the safety of their operations.

Since each carrier charges different rates in each county, it is not unusual to see significantly lower rates in selected parts of the state. Our job is to determine your needs, find the lowest prices that give you the benefits you are looking for, and recommend the most affordable high-quality healthcare plan for your situation.If you move to a different city or county, we can provide an instant comparison of available plan options.

Ohio health insurance company information. View Exchange plans at the lowest available rates and apply without answering medical questions.

Rates are mandated by the Department of Insurance, so you receive the lowest prices at all times. If a carrier files for a rate reduction or a consumer rebate, we will help explain the process and how you can quickly benefit by those changes.Typically, Marketplace rates for persons under age 65, are published in September or October. Price change requests are provided to the DOI by June.

Your Zip Code And County Of Residence Matters

Although medical conditions no longer impact premiums, the “servicing area” (where you reside) does. For example, below we have illustrated the monthly rates for a 30 year-old married couple (2 persons) with annual income of $48,000. The least expensive available plan was selected. Note price differences in several areas:

$0 – 43711 Noble County (CareSource Marketplace Bronze)

$30 -45373 Miami County (Anthem Bronze Pathway X HMO 8550)

$45 – 43713 Belmont County (Ambetter Essential Care 1)

$52 – 43232 Franklin County (Ambetter Essential Care 1)

$45 – 43782 Perry County (Oscar Bronze Simple)

$62 – 45242 Hamilton County (Ambetter Essential Care 1)

$65 – 43734 Muskingum County (CareSource Marketplace Bronze)

$67 – 43610 Lucas County (Ambetter Essential Care 1)

$75 – 44142 Cuyahoga County (Ambetter Essential Care 1)

$78 – 45780 Athens County (Molina Core Care Bronze 2)

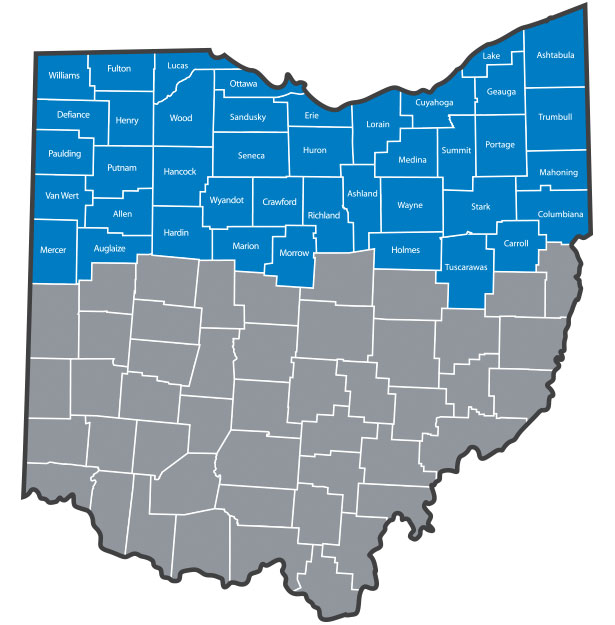

Your County of residence is also a major factor regarding available plans, pricing, network providers, and the number of companies registered to offer policies. Specific carriers only offer coverage in certain areas. For example, Summacare Medicare Advantage plans are available only in the Counties shaded blue in the map below. Note: Image provided by SummaCare and is subject to change.

Also, Medical Mutual’s rates are more favorable in specific parts of the state. In the Cincinnati area, Medical Mutual offers extremely competitive HSA and comprehensive plan rates. By using our experience and expertise, we will help you identify your best options. Anthem Blue Cross tends to offer competitive prices in most parts of Ohio. Ambetter and SummaCare feature many low-cost options. Ambetter offers very competitive prices with copays for pcp and specialist office visits. SummaCare services the Northern part of the state. Oscar is also offered in the Cleveland and Columbus areas.

Need Coverage For Only A Few Months?

If your need is temporary, a short-term plan will be your best option. While many companies offer short-term plans, HCC Life, National General, and UnitedHealthcare offer the most affordable options. Typically, temporary coverage costs less (approximately 30%-60%) than comprehensive policies, and applications are often approved in less than 24 hours. Premiums can be paid monthly, and the entire process can be completed online.

Anthem also offers short-term plans and includes prescription drug and office visit benefits. Some pre-existing conditions are covered and seven different deductibles are available.

Although these types of plans do not cover pre-existing conditions, they are a great fit for individuals and families that only need benefits for less than 12 months. However, they do NOT include “essential health benefits,” a signature requirement of the Affordable Care Act. Also, prescription drug benefits are generally much less robust when compared to Marketplace plans.

Dental Plans In Ohio

Although dental benefits can be obtained (pediatric and adult) at the time you purchase medical coverage during Open Enrollment, private plans can be applied for at any time. There also is no prior-coverage requirement. Typically, preventative benefits are covered at or neat 100% (teeth cleanings and semi-annual exams). However, major procedures, such as crowns, bridges, root canals, and dentures, require a copay and deductible to be met.

Currently, the following major carriers offer individual and family policies: Humana, Aetna, UnitedHealthcare, Medical Mutual, Anthem Blue Cross, IHC Group, and National General.

Review

If you would like to quickly view, compare or apply for an Ohio health insurance policy, please enter your zip code in the “Get Free Quotes” section at the top of the page. You can also talk to us live by calling or emailing. The “contact us” button at the top of the page is an additional method to contact us for information regarding companies, plans, rates, or availability in your area.