Last Updated on by Ed Harris

HealthSpan health insurance rates in Ohio were among the cheapest options for individuals, Medicare patients, and small businesses in the service area. Locally based in Cincinnati, they are a non-profit company that works with Catholic Health Partners (CHP), the Buckeye State’s biggest medical system. Their HSA plans were popular Marketplace options for single persons and families.

HealthSpan purchased Kaiser Foundation Health Plan of Ohio in 2013 and also took over Kaiser Permanente policies. At that time, all Kaiser policies continued in force without interruption. And now, commercial, individual, Medicare, and Medicaid options are offered to residents of the state.

But HealthSpan (part of MercyHealth) ceased offering Marketplace plans, due to excess claims and high administrative and operating expenses. After losing more than $100 million in the first six months of 2015, it became quickly clear that the loss of the Kaiser business and other factors would force the termination of all health insurance policies. Medigap plans for Seniors, and private individual coverage have been terminated, with Medical Mutual partnering in the transition, to help customers find new policies.

As of December 31, 2016, private medical contract for persons under age 65, Medicare Advantage, and Medicare Plus contracts were no longer in effect. Although Medical Mutual options were offered, if available in the applicant’s service area, prior customers were able to choose from any carrier offering policies. Federal Employees Health Benefits (FEHB) program members will also have their coverage administered by Medical Mutual.

If a transfer of medical records is needed, a disclosure form is available and should be sent to Mercy Health. The form authorizes the usage of protected medical information.

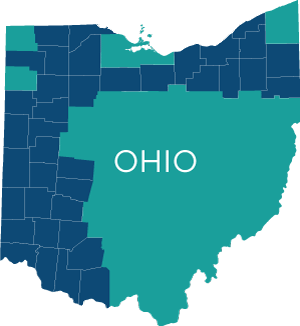

NOTE: Counties where Medical Mutual individual coverage is not available include Adams, Auglaize, Belmont, Brown, Clinton, Coshocton, Darke, Defiance, Fulton, Greene, Guernsey, Hancock, Harrison, Henry, Highland, Huron, Mercer, Miami, Monroe, Montgomery, Monroe, Muskingum, Noble, Ottawa, Perry, Preble, Seneca, Shelby, Stark, Tuscarawas, Van Wert, Warren, Washington, and Wayne. FEHB plans have additional counties that are not in the service area.

Previously Available HealthSpan Plans In Ohio

Bronze-Tier

Select Bronze 4500-70 HSA – HSA eligible with $4,500 deductible and maximum $6,550 out-of-pocket expenses. Coinsurance is 30%.

Select Bronze 6000 HSA – About the same price as previous plan, despite higher $6,000 deductible. However, coinsurance is 0% and maximum out-of-pocket expenses are only $6,000.

Select Bronze 5500-80 – Cheapest non-HSA policy that features a $30 copay on pcp visits and $20 generic drug copay. Deductible is $5,500 and a copay is also offered for substance use disorder outpatient services ($30) and rehab services ($60).

Affordable Comprehensive Plans

Silver 1500-70-HSA – Low $1,500 deductible for an HSA option. 30% coinsurance and maximum out-of-pocket cost of $5,000. Since it is a Silver-tier plan, cost-sharing is available if household income is less than 250% of Federal Poverty Level. This can result in thousands of dollars in savings.

Silver 2500-80 – Low $15 copay on office visits ($40 for specialists) and fairly low $2,500 deductible on major medical claims. Generic drugs also are covered with $10 copay instead of a deductible.

Silver 2000-70 – Almost identical to previous plan, although coinsurance is 30% instead of 20%. Rate is also about 1% higher.

Gold 1000-80 – Low $10 and $30 copays on office visits with a $1,000 deductible. This option is one of the least expensive “Gold” tier plans offered in Ohio.

Gold 2000-100 – $2,000 lower maximum out-of-pocket costs than previous plan ($5,000 vs. $3,000). However, deductible is $2,000 instead of $1,000 and there is no coinsurance. Most other features are similar.

Gold 250-70 – The “Cadillac” of the portfolio, this plan features a super-low $250 deductible with $10 and $30 copays on office visits. Most drugs are not subject to a deductible and the maximum out-of-pocket expense is $3,000. This policy is one of the most reasonably-priced options in the entire state. However, if your health is perfect, you may be paying for coverage you don’t utilize.

Provider Network

Although less than 25 years old, their network of physicians, hospitals and other related facilities is fairly large. With more than 22,000 available options, in most areas of the state, you won’t have to drive far to get treatment. Also, direct contact with a claims administrator is available by viewing the back of the ID card that is issued. The dark areas of the image above show the network coverage area. Central and Eastern Ohio are obviously not areas where policies can be purchased.

To search for a provider in your area, previously you could find additional information regarding the type of treatment you need, and search by name or area. We can also verify a specific physician is “in network,” by providing us the name and address of who you are trying to find.

NOTE: The focus of the company is obviously the western portion of the state. We have noticed that in Warren, Montgomery, and many other counties in the Dayton area, HealthSpan is often (along with Aetna and sometimes UnitedHealthcare and Ambetter) the most competitively-priced carrier and offers several very attractive plans.

Coaches

OK…Not football coaches, but yes, HealthSpan provides a staff of “coaches” that are available to help you get healthier, stay fit, and if applicable, make positive changes. The professional staff consists of a wide range of experts, including registered nurses, fitness instructors, and psychologists. They provide motivation, organization, and a multitude of resources that can help you achieve your goals. Your cost is nothing. All of the personal attention is free.

There are also conventional programs that are included that many customers are more familiar with. Some examples are: smoking and tobacco cessation, managing blood sugar, stress management, and weight management. Each program can be specifically fitted to match your unique needs and closely monitored.

The “CompleteCare” program includes a biometric analysis and is URAC accredited. It is designed to identify future health-related risks and also reduce or eliminate existing risk factors. Whether you are extremely healthy or are being treated for critical illnesses, there are several approaches that can help. Members who participated in the past showed a 30% reduction in medical care costs.

Medicare Advantage Products

Three plans were available. All policies utilized the Medicare Advantage network and included supplemental benefits. Rates shown below were for Hamilton County (Cincinnati). Prices can slightly vary in different ares of the state. Additional options were offered in other counties.

Medicare Value – $0 per month. $4,000 maximum out-of-pocket expenses. Office visit copays are $0 and $40. Inpatient hospital expenses are $270 per day for first 7 days with $300 outpatient surgery copay. No charge for diagnostic lab tests. X-ray copay is $100 with $275 charge for MRI, CT, and PET scans. Ambulance service copay is $275. Eyewear, dental and hearing aid benefits are not provided.

Medicare Standard – $49 per month. $3,700 maximum out-of-pocket expenses. Office visit copays are $0 and $30. Inpatient hospital expenses are $185 per day for first 7 days with $200 outpatient surgery copay. No charge for diagnostic lab tests. X-ray copay is $75 with $200 charge for MRI, CT, and PET scans. Ambulance service copay is $225. $1,000 of hearing aid coverage (every three years) is included. $100 benefit for eyeglasses and contact lenses are provided every two years.

Medicare Enhanced – $99 per month. $3,500 maximum out-of-pocket expenses. Office visit copays are $0 and $20. Inpatient hospital expenses are $0 per day with $125 outpatient surgery copay. No charge for diagnostic lab tests. X-ray copay is $50 with $125 charge for MRI, CT, and PET scans. Ambulance service copay is $150. $1,500 of hearing aid coverage (every three years) is included. $150 benefit for eyeglasses and contact lenses are provided every two years.

Part D prescription coverage was available with “Advantage Plus,” a supplemental dental, eyewear and hearing rider. The cost of the rider was $23 per month and additional specific details are available.

Although they are not actively involved in the marketing or offering of all Medicare-Supplement plans, HealthSpan does provide management and provider assistance services in certain part of the state. SummaCare and MediGold are two Medicare Advantage plans that they offer consumers help in the enrollment process.

If you are simply waiting for Ohio Medicare coverage to start, we wrote an article (see link) that explains some of the best options to consider, and which types of policies will cover any gaps until you turn 65. Of course, you will not need private medical benefits at that time.

Senior Changes

NOTE: There have been several changes to Medicare that are effective with the new year. Many Part D drug policies are more expensive due to the rising cost of prescriptions. Copays may increase on your plan, so any changes should be monitored. Also, Advantage plans are more costly since the federal government is not contributing as much funding as in previous years. The maximum Part Deductible is also going up $10, to $320. However, Part B premiums are remaining the same.

Comparison Of Provider Costs

A unique service is the free comparison tool that shows you the lowest (and highest) prices for many common medical procedures. MRIs, X-Rays, Colonoscopies and CT-Scans are a few of the many available types of treatment you can shop for. Easily budget and plan for much of your healthcare treatment from an unbiased resource.

If you have an HSA or high-deductible plan, and rely on network-negotiated repricing to save you money, this feature should provide even more savings. You’ll also be able to compare the level of quality provided by each provider. Average savings by utilizing these services amounts to about 25%-50%. This tool is especially helpful if you are receiving benefits that are covered, but will be subject to your deductible.

HealthSpan rates in Ohio are affordable individual and family options, regardless of what medical conditions exist. You can quickly view and compare prices by requesting a free quote at the top of the page. Both on and off-Exchange policies are offered.

PAST UPDATES:

Employers in the northern portion of the state will be able to offer self-funded coverage for effective dates. HealthSpan Choice is managed and maintained by the company for its employees. This results in increased flexibility and control of the offered plans. The Lorain County area will be one of the areas that may see the largest benefit, thanks to the inclusion of UH Elyria and Mercy networks.

More than 10,000 employees from Mercy Health will be joining forces with HealthSpan in January. Most of the workers are from the Toledo/Lorain area, and are now part of a self-funded medical program. Medical Mutual had previously handled the account. Comprehensive prevention is one area of extended support that is expected to reduce costs and claims in 2015.

HealthSpan insurance rates in Ohio for persons under age 65, are not as competitive as they were in 2015. Prices have increased, and quite substantially for many plans. In several areas, HSA prices are attractive, but their copay and comprehensive options are often more expensive than many other carriers.

Northeast Ohio will lose its network physicians group, and may leave a void in available Cleveland-area doctors and other medical facilities. It is hoped that many of the persons losing their jobs will find employment opportunities with MetroHealth or Summa Physicians. Anticipated financial losses caused by much higher claims from policyholders, has forced the company to strongly consider terminating its entire under age-65 portfolio (with the exception of Medicaid patients).

The closing of 11 health centers may still allow customers to retain their doctors. Otherwise, HealthSpan will assist in finding a new provider.

HealthSpan no longer offers individual plans. Unanticipated high numbers of claims doomed the carrier, along with several others. Under the Trump administration, we do not expect a return, although many other companies are expected to return.