Last Updated on by Ed Harris

When you choose your health insurance coverage in Ohio, it is important to compare the best plans that are offered. But not just one company or one policy. Rather, dozens of different medical plans from all of the best insurers in the Marketplace, so you know you’re finding quality, yet affordable coverage. Reviewing plans that are eligible for federal subsidies, and unsubsidized options allow you to save the most money.

Picking the most economical policy for yourself, dependents and other family members involves calculating your government subsidy, which is based on the “Federal Poverty Level.” It’s a rather simple concept. The lower your AGI (Adjusted Gross Income), the more help you are going to get from Uncle Sam. But the process can be confusing, so we automatically show you the amount you are eligible for with every quote. Occasionally, the premium will be $0.

Seniors that have reached age 65 and/or are eligible for Medicare, are not offered the same plans or federal assistance. However, the combination of Medicare benefits and Medigap supplement coverage (including Advantage plans), typically costs less than traditional Under-65 policies. Maximum out-of-pocket expenses are also lower, and a high-deductible Plan F (HD) is offered. High-deductible Plan G (HD) is offered as a new plan.

We Search So You Save

We save you money by searching companies like Anthem Blue Cross, Medical Mutual, Humana, Aetna, Ambetter, Molina, SummaCare, UnitedHealthcare, and many more. We provide their lowest direct rates so you can safely apply or enroll for the best available plan. We research every option (more than 500!) and help you understand which features you should be looking for, and at what cost. For instance, if you need weekly physical therapy, we show you the plans that minimize those costs. If you must have unlimited specialist visits with low copays, we will find those policies.

If you are currently insured under a group or individual contract, we happily review your benefits, and give you expert advice regarding what changes (if any) will lower your costs. In recent years, many small and large businesses are scaling back benefits and employee working hours, which often means you need to begin shopping for alternative medical coverage.

Non-Obamacare plans have also become increasingly popular with the removal of the non-compliant penalty. Although a federal subsidy is not offered, often, premiums are very low, and policies can be approved within 24 hours. Aetna and UnitedHealthcare provide PPO networks that can be used countrywide.

Review Your Own Expenses

One of the best ways to reduce your premium is to examine your healthcare expenses from the prior year. That is, how much did you spend and what services did you receive. Were most of the costs associated with one person or one condition? Are these conditions still present or have they been treated and are no longer an issue? Do you suspect you may need a procedure or surgery in the next 12 months? Has your overall health declined in the last five years?

All of these questions are important in determining the type of coverage you should have. For example, if you answered “yes” to most of those questions, then minimizing your expected out-of-pocket costs for 2021 should be a priority. It may also mean that you will have to remain with your existing company (at least for now) until you can qualify for a less-expensive plan.

But assuming you are very (or fairly) healthy, and you had reasonably few expenses this year, and previous years, you need to ensure that your current coverage is designed to minimize your premium. Here’s how:

Your Medical History

Ask yourself how many times you saw a physician in the last three years. But don’t count any preventive visits such as annual physicals or OBGYN exams. Was your answer less than five? If it was, and you have a “copay” on your policy, you may be putting dollars in places that aren’t so cost-effective. Often, a simple trip to see the doctor for a virus costs between $50 and $100, depending upon where you live. So if you have a copay of $35 and the cost was $70, you only saved $35 (or less if you factor in the discount).

If you had to pay out-of-pocket for eight visits (in this example), that might have cost between $400 and $700, depending on where you live, and of course, the amount your doctor charges you. However, if your policy was structured so that symptomatic office visits were discounted instead of being subject to a copay, you might have saved between $1,200 and $3,000. That’s a better deal!

Naturally, there are many variables, including other benefits that may have been utilized (such as prescriptions) or the number of family members on the policy. But ironically, the more healthy persons you insure, the bigger the savings becomes when you eliminate the copay. If you have at least four members of your family and everyone is at least eight years old, getting rid of the non-preventive copay benefits may make a huge difference.

Exchange Plans

The only Available “Metal” plan that is not eligible for federal tax credits is the “catastrophic option”. You must be under 30 years old, or meet a “financial hardship” requirement to be able to purchase that policy. Otherwise, you can consider plans that are not offered through the Exchange, or other “non-catastrophic” policies. However, forfeiting your subsidy eligibility (if you meet income requirements) may not be a sensible financial choice.

Product changes often provide low-cost plan options that feature comprehensive benefits at a very reasonable cost. Although not available in all areas of the Buckeye State, several examples are : Molina Core Care Bronze 2, Molina Constant Care Silver 2 250, Oscar Simple Bronze, Anthem Bronze Pathway X HMO 8150, SummaCare Bronze 8150, and SummaCare Silver 6000.

But if they were purchased in 2010 or earlier, you may be able to retain benefits under the “grandfather” clause, although these policies are rarely in-force. This allows you to keep the contract without being forced to add any required benefits. If you changed your deductible after you originally purchased the policy, you may not be allowed to keep it. Retired persons who are covered by their prior employer’s Group benefits, may also be covered under plans that are no longer offered.

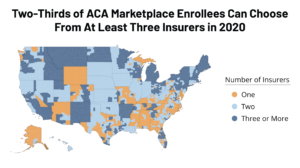

The graphic below (courtesy of Kaiser) illustrates that most counties in Ohio offer several Marketplace carriers. Many of these policies offer special features that reduce deductibles at no extra cost. CHIP can also help children in low-income households. Ambetter, Medical Mutual, Molina, and CareSource offer coverage in the most counties. SummaCare, Oscar, and Paramount have limited service areas.

Shopping online continues to be the most efficient option to find the lowest premiums. Fewer plans and companies are now available, and of course, rates have increased. However, help may be coming in 2021, when (hopefully), Congress can agree to pass cost-saving legislation.Until that time, our customized software and live assistance will help you find the best available plans at the lowest available cost.