Paramount provides affordable health insurance coverage in Northwest Ohio to individuals, families, employees, and persons eligible for Medicare and Medicaid. As an affiliate of ProMedica, they are locally-owned (Maumee), and are the largest health maintenance organization (HMO) in the area. The locally-owned company features excellent satisfaction ratings for its group medical, dental, Worker’s Compensation, and Senior Medicare products, providing popular options for residents in Ohio, Michigan, and Indiana. Dental and workman’s comp coverage is also offered.

ProMedica is a non-profit mission-based healthcare organization consisting of more than 56,000 employees and 3,000 physicians and healthcare providers. Private plans are offered to applicants that are eligible for Affordable Care Act federal subsidies, and also persons with incomes that don’t qualify for Obamacare financial assistance. More than 600,000 members were covered last year through Medicare, Medicaid, and additional commercial lines of business. A 24/7 nurse line is available for all policyholders. Online physician visits are also offered.

In-network hospitals include: ProMedica Toledo, ProMedica Russell J. Ebeid Childrens, ProMedica Bay Park, ProMedica Flower, Wood County, ProMedica Memorial, Fulton County Health, ProMedica Charles And Virginia Hickman, Henry County, MaGruder, ProMedica Fostoria Community, ProMedical Defiance Regional, Wyandot Memorial, University of Toledo Medical Center, Mercy Health St. Vincent Medical Center, Mercy St. Charles, Mercy Health St. Anne, ProMedica Bay Park, Coldwater Family Medical Center, ProMedica Defiance Regional Hospital, Lima Memorial Health System, Bay Park Hospital, Flower Hospital, and ProMedica Monroe Regional Hospital.

Paramount Individual And Family Plans (Under Age 65)

Marketplace plans are offered in the following counties: Defiance, Erie, Henry, Huron, Lucas, Ottawa, Sandusky, Seneca, Williams, Wood, and Wyandot. Federal subsidies are provided to all eligible applicants (must be US citizen and a legal resident of Ohio). When an employer offers qualified medical benefits, a subsidy may not be available. Medicare and Medicaid-eligible applicants are not eligible for tax credits on Marketplace plans.

Bronze Tier

Paramount Bronze 1 HSA – $6,000 deductible with 50% coinsurance and maximum out-of-pocket expenses of $7,500. $35 primary care office visit copay subject to deductible. Policy is HSA-eligible.

Paramount Bronze 3 HSA – $6,000 deductible with 50% coinsurance and maximum out-of-pocket expenses of $7,500. $35 primary care office visit copay subject to deductible. Policy is HSA-eligible.

Paramount Bronze 2 HRA – $9,450 deductible with 0% coinsurance and maximum out-of-pocket expenses of $9,450.

Paramount Bronze 4 HRA – $9,450 deductible with 0% coinsurance and maximum out-of-pocket expenses of $9,450.

Paramount Expanded Bronze Standard 1 – $7,500 deductible with 50% coinsurance and maximum out-of-pocket expenses of $9,400. Pcp and specialist office visit copays are $50 and $100. $75 Urgent Care copay.

Paramount Expanded Bronze Standard 2 – $7,500 deductible with 50% coinsurance and maximum out-of-pocket expenses of $9,400. Pcp and specialist office visit copays are $50 and $100. $75 Urgent Care copay.

Silver Tier

Paramount Silver 1 – $4,000 deductible with 30% coinsurance and maximum out-of-pocket expenses of $9,000. $20 pcp and $75 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $75 Urgent Care copay. $400 ER copay.

Paramount Silver 2 – $6,500 deductible with 30% coinsurance and maximum out-of-pocket expenses of $8,000. $25 pcp and $75 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $75 Urgent Care copay. $400 ER copay.

Paramount Silver 4 – $7,000 deductible with 40% coinsurance and maximum out-of-pocket expenses of $8,500. $35 pcp and $75 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $100 Urgent Care copay.

Paramount Silver 5 – $4,000 deductible with 30% coinsurance and maximum out-of-pocket expenses of $9,000. $20 pcp and $75 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $75 Urgent Care copay. $400 ER copay.

Paramount Silver 6 – $6,500 deductible with 30% coinsurance and maximum out-of-pocket expenses of $8,000. $25 pcp and $70 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $75 Urgent Care copay. $400 ER copay.

Paramount Silver 4 HRA – $7,000 deductible with 40% coinsurance and maximum out-of-pocket expenses of $8,500. $35 pcp and $75 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $100 Urgent Care copay.

Paramount Silver Standard 1 – $5,900 deductible with 40% coinsurance and maximum out-of-pocket expenses of $9,100. $40 pcp and $80 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $60 Urgent Care copay.

Paramount Silver Standard 2 – $5,900 deductible with 40% coinsurance and maximum out-of-pocket expenses of $9,100. $40 pcp and $80 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $60 Urgent Care copay.

Gold Tier

Paramount Gold 1 – $2,500 deductible with 20% coinsurance and maximum out-of-pocket expenses of $6,500. $15 pcp and $55 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $55 Urgent Care copay.

Paramount Gold 3 – $2,500 deductible with 20% coinsurance and maximum out-of-pocket expenses of $6,500. $15 pcp and $55 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $55 Urgent Care copay.

Paramount Gold Standard 1 – $2,000 deductible with 25% coinsurance and maximum out-of-pocket expenses of $8,700. $30 pcp and $60 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $45 Urgent Care copay.

Paramount Gold Standard 2 – $2,000 deductible with 25% coinsurance and maximum out-of-pocket expenses of $8,700. $30 pcp and $60 specialist office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $25, $50, and $250. $45 Urgent Care copay.

Sample Paramount Rates (Monthly)

Lucas, Defiance, Henry, and Wood Counties

32-Year-Old With $32,000 Household Income

$1 – Bronze 2 HRA

$15 – Expanded Bronze Standard 1

$32 – Bronze 1

$117 – Silver Standard 1

$124 – Silver 4 HRA

$136 – Silver 2

$144 – Silver 1

$180 – Paramount Gold Standard 1

$190 – Paramount Gold 1

32-Year-Old Married Couple With $46,000 Household Income

$2 – Bronze 2 HRA

$4 – Expanded Bronze Standard 1

$38 – Bronze 1

$209 – Silver Standard 1

$222 – Silver 4 HRA

$247 – Silver 2

$262 – Silver 1

$334 – Paramount Gold Standard 1

$354 – Paramount Gold 1

35-Year-Old Married Couple Plus Two Children With $67,000 Household Income

$3 – Bronze 2 HRA

$3 – Expanded Bronze Standard 1

$3 – Bronze 1

$279 – Silver Standard 1

$301 – Silver 4 HRA

$343 – Silver 2

$369 – Silver 1

$489 – Paramount Gold Standard 1

$524 – Paramount Gold 1

50-Year-Old With $39,000 Household Income

$35 – Bronze 2 HRA

$64 – Expanded Bronze Standard 1

$90 – Bronze 1

$219 – Silver Standard 1

$228 – Silver 4 HRA

$247 – Silver 2

$259 – Silver 1

$313 – Paramount Gold Standard 1

$328 – Paramount Gold 1

50-Year-Old Married Couple With $48,000 Household Income

$2 – Bronze 2 HRA

$3 – Expanded Bronze Standard 1

$3 – Bronze 1

$260 – Silver Standard 1

$280 – Silver 4 HRA

$318 – Silver 2

$341 – Silver 1

$449 – Paramount Gold Standard 1

$480 – Paramount Gold 1

60-Year-Old With $39,000 Household Income

$2 – Bronze 2 HRA

$5 – Expanded Bronze Standard 1

$44 – Bronze 1

$240 – Silver Standard 1

$255 – Silver 4 HRA

$343 – Silver 2

$369 – Silver 1

$489 – Paramount Gold Standard 1

$524 – Paramount Gold 1

60-Year-Old Married Couple With $48,000 Household Income

$4 – Bronze 2 HRA

$4 – Expanded Bronze Standard 1

$4 – Bronze 1

$303 – Silver Standard 1

$333 – Silver 4 HRA

$390 – Silver 2

$426 – Silver 1

$590 – Paramount Gold Standard 1

$637 – Paramount Gold 1

Erie, Huron, Ottawa, and Wyandot Counties

28-Year-Old With $25,000 Household Income

$98 – Bronze 4 HRA

$134 – Bronze 3 HSA

$252 – Silver 6

$273 – Silver 5

$311 – Gold 3

28-Year-Old Married Couple With $34,000 Household Income

$173 – Bronze 4 HRA

$246 – Bronze 3 HSA

$481 – Silver 6

$525 – Silver 5

$601 – Gold 3

32-Year-Old Married Couple Plus Two Children With $60,000 Household Income

$344 – Bronze 4 HRA

$475 – Bronze 3 HSA

$896 – Silver 6

$974 – Silver 5

$1,110 – Gold 3

Short-Term Coverage

Short-term coverage is available at all times, including outside of Open Enrollment periods,and provides low-cost non-ACA options. Federal subsidies are not offered and pre-existing conditions are generally not covered. These types of temporary policies are popular for healthy applicants that do not qualify for an Obamacare credit.

Plan 1 – 3, 6, 9, and 364 days of coverage are offered. $40 primary-care physician copay. ProMedica On Demand visits subject to $0 copay. Specialist visits subject to $10,000 policy deductible and 40% coinsurance. Urgent Care and ER copays are $75 and $250. Inpatient and outpatient hospital visits are covered and subject to 40% coinsurance. The out-of-pocket maximum is $20,000.

Plan 2 – 3, 6, 9, and 364 days of coverage are offered. $40 primary-care physician copay. ProMedica On Demand visits subject to $0 copay. Specialist visits subject to $5,000 policy deductible and 30% coinsurance. Urgent Care and ER copays are $75 and $250. Inpatient and outpatient hospital visits are covered and subject to 30% coinsurance. The out-of-pocket maximum is $15,000.

Plan 3 – 3, 6, 9, and 364 days of coverage are offered. $40 primary-care physician copay. ProMedica On Demand visits subject to $0 copay. Specialist visits subject to $2,500 policy deductible and 20% coinsurance. Urgent Care and ER copays are $75 and $250. Inpatient and outpatient hospital visits are covered and subject to 20% coinsurance. The out-of-pocket maximum is $10,000.

Sample Short-Term (364 days) Monthly Rates Below:

30-Year-Old Female

Plan 1 – $59.55

Plan 2 – $85.08

Plan 3 – $120.13

35-Year-Old Male

Plan 1 – $68.06

Plan 2 – $97.24

Plan 3 – $137.29

40-Year-Old Male

Plan 1 – $76.13

Plan 2 – $108.77

Plan 3 – $153.57

45-Year-Old Female

Plan 1 – $108.53

Plan 2 – $155.06

Plan 3 – $218.93

50-Year-Old Female

Plan 1 – $137.70

Plan 2 – $196.74

Plan 3 – $277.77

55-Year-Old Male

Plan 1 – $177.69

Plan 2 – $253.88

Plan 3 – $358.44

60-Year-Old Female

Plan 1 – $196.80

Plan 2 – $281.18

Plan 3 – $396.99

Paramount Ohio Senior Medicare Coverage

Medicare Advantage Plans

Paramount Elite Standard – $0 monthly premium with $0 deductible and maximum out-of-pocket expenses of $4,200. Prescription drug copays are $0 (preferred generic), $0 (generic), $45 (preferred brand), $100 (non-preferred), and 33% (specialty). 4,475 members are enrolled in the plan and the Summary Star rating is 4.0. Office visit copays are $0 (primary) and $35 (specialist). Diagnostic tests and procedures have a $20 copay, lab services have a $0-$5 copay, diagnostic radiology services have a $0- $200 copay and outpatient x-rays have a $20 copay. The Urgent Care and ER copays are $45 and $90. The inpatient hospital copay is $325 for 5 days. Outpatient hospital visits are subject to a $0-$275 copay while the skilled nursing facility copays are $0 (days 1-20), and $188 (days 21-100).

The ground ambulance copay is $250 and rehabilitation copays are $35 (speech and language therapy, occupational therapy, and physical therapy). Mental health services and opioid treatment copays are $35. Hearing exams are subject to a $0-$35 copay, and hearing aids have a $0 copay. Preventative dental benefits are covered with a $0 copay, and comprehensive dental coverage is included. Vision benefits include a $0 copay for routine eye exams, contact lenses, eyeglass lenses, and eyeglass frames. Foot exams and treatment have a $35 copay. Optional comprehensive dental plans are available.

Paramount Elite Prevail – $0 monthly premium and maximum out-of-pocket expenses of $5,900. Prescription drug coverage is not included. 82 members are enrolled in the plan and the Summary Star rating is 4.0. Office visit copays are $0 (primary) and $35 (specialist). Diagnostic tests and procedures have a $10 copay, lab services have a $0-$5 copay, diagnostic radiology services have a $0-$200 copay and outpatient x-rays have a $10 copay. The Urgent Care and ER copays are $45 and $90. The inpatient hospital copay is $300 for 5 days. Outpatient hospital visits are subject to a $0-$200 copay while the skilled nursing facility copays are $0 (days 1-9), $20 (days 10-20), and $188 (days 21-100).

The ground ambulance copay is $250 and rehabilitation copays are $25 (speech and language therapy, occupational therapy, and physical therapy). Mental health services and opioid treatment copays are $35. Hearing exams are subject to a $0-$35 copay, and hearing aids have a $0 copay. Preventative dental benefits are covered with a $0 copay, and some comprehensive dental coverage is also included. Vision benefits include a $0 copay for routine eye exams, contact lenses, eyeglass lenses, and eyeglass frames. Foot exams and treatment have a $35 copay.

Paramount Elite Prime – $28 monthly premium with $0 deductible and maximum out-of-pocket expenses of $3,700. Prescription drug copays are $0 (preferred generic), $0 (generic), $45 (preferred brand), $100 (non-preferred), and 33% (specialty). 3,234 members are enrolled in the plan and the Summary Star rating is 4.0. Office visit copays are $0 (primary) and $35 (specialist). Diagnostic tests and procedures have a $15 copay, lab services have a $0-$5 copay, diagnostic radiology services have a $0-$165 copay and outpatient x-rays have a $15 copay. The Urgent Care and ER copays are $40 and $90. The inpatient hospital copay is $310 for 5 days. Outpatient hospital visits are subject to a $0-$250 copay while the skilled nursing facility copays are $0 (days 1-20), and $196 (days 21-100).

The ground ambulance copay is $250 and rehabilitation copays are $25 (speech and language therapy, occupational therapy, and physical therapy). Mental health services and opioid treatment copays are $35. Hearing exams are subject to a $0-$35 copay, and hearing aids have a $0 copay. Preventative dental benefits are covered with a $0 copay, but comprehensive dental coverage has limitations. Vision benefits include a $0 copay for routine eye exams, contact lenses, eyeglass lenses, and eyeglass frames. Foot exams and treatment have a $35 copay. Optional comprehensive dental plan is available.

Paramount Elite Enhanced – $68 monthly premium with $0 deductible and maximum out-of-pocket expenses of $3,400. Prescription drug copays are $0 (preferred generic), $10 (generic), $42 (preferred brand), $100 (non-preferred), and 33% (specialty). 6,660 members are enrolled in the plan and the Summary Star rating is 4.5. Office visit copays are $0 (primary) and $40 (specialist). Diagnostic tests and procedures have a $10 copay, lab services have a $0-$5 copay, diagnostic radiology services have a $0-$100 copay and outpatient x-rays have a $10 copay. The Urgent Care and ER copays are $40 and $90. The inpatient hospital copay is $225 for 5 days. Outpatient hospital visits are subject to a $0-$225 copay while the skilled nursing facility copays are $0 (days 1-9), $20 (days 10-20), and $188 (days 21-100).

The ground ambulance copay is $200 and rehabilitation copays are $25 (speech and language therapy, occupational therapy, and physical therapy). Mental health services and opioid treatment copays are $40. Hearing exams are subject to a $40 copay, and hearing aids have a $0 copay. Preventative dental benefits are covered with a $0 copay, but comprehensive dental coverage is not included. Vision benefits include a $0 copay for routine eye exams, contact lenses, eyeglass lenses, and eyeglass frames. Foot exams and treatment have a $40 copay. Limited comprehensive dental coverage is included.

Note: Paramount does offer Part D drug prescription plans in Ohio.

Paramount Advantage Medicaid (Acquired by Anthem Blue Cross And Blue Shield)

Coverage is offered to Medicaid-eligible applicants in the network service area. Most benefits are provided at no cost. Many of the most popular benefits are listed below:

Medical Benefits – Appointments with physicians and specialists, ER and Urgent Care visits, x-rays, blood work, surgery, ambulance transportation, outpatient and inpatient visits.

Prescription Drugs – Over-the-counter drugs, unified preferred drugs, preferred diabetic supplies, and specialty drugs.

Dental – Two annual routine oral exams per year for persons under age 21 (one exam 21 and older), simple extractions and restorations, x-rays, fillings, orthodontia, general anesthesia, partial and full dentures, surgical extraction, post and core crowns, and root canals.

Vision – One vision exam every 1-2 years (depends on age), one pair of lenses or frames every 1-2 years (depends on age), and network provider discounts.

Behavioral Health – Services are provided for drug or alcohol dependence, depression, and anxiety. A 24/7 nurse line is available.

Care Management – Qualifying conditions may include: Children with special needs, spinal chord injuries, severe burns and trauma, organ transplant, cancer, premature birth, mental health, substance abuse, newly-diagnosed or uncontrolled diabetes, hospitalization for sudden condition, and HIV.

HealthChek – EPSDT (Early and periodic screening, diagnostic, and treatment) treats persons under age 21 that are Medicaid-eligible. Benefits are provided without cost and cover the following: immunizations, lab tests, lead testing, complete physicals, dental and vision exams, nutrition checks, hearing exams, and developmental exams.

Additional Paramount Medical Services

Free Same-Day Pregnancy Test – Virtual provider finds testing location near your residence. Results are returned within 24 hours and an appointment with a physician is scheduled (if needed).

Prenatal To Cradle – Up to $150 in reward cards is available along with assistance before and after birth.

Cradle To Crib – $100 gift card available for well-baby visits. Vaccinations, eating, sleeping, and other topics discussed.

Cleveland Browns Healthy Awards – Rewards given for annual well-visits. Prizes include autographed footballs, replica jerseys, collectables, and accessories. You will also be given a chance to ask questions to Browns players during a video call. And hopefully, the Browns will make the playoffs!

Who Dey! Healthy Rewards – Rewards given for annual well-visits. Additional rewards provided (see above).

Perks For Veterans – The Department of Veterans Affairs assists Paramount with ensuring that Vets are receiving the appropriate healthcare. There are no out-of-pocket expenses with Service Connected Disabilities. Additional assistance may involve groceries, housing, utilities, and finances.

Personalized Customer Service – A specific representative can be assigned to handle all of your needs.

Paramount Dental Coverage In Ohio

A “Network Access” plan is offered to individuals and families offers basic dental coverage with network discounts. Participating dentists have contractually agreed to perform specific services at stated prices. A $100 annual benefit is also provided, although unused amounts do not carry over from one year to the next year. Coverage is applied directly to covered services with reimbursement forwarded to the dentist. After the claim is submitted, an explanation of benefits (EOB) will be provided. Changes and additions of covered persons can be completed when the policy renews. Only one application is needed regardless of the number of family members. The policy is renewable, and there is no dependent age limit. There is also no age limit for adult plan members. If any plan member obtains group dental benefits through an employer, the Paramount coverage is not impacted.

Typical Savings For Common Dental Services

50% – Application of fluoride (D1208)

29% – Wisdom teeth removal (D7230)

25% – Periodic dental exam (D0120)

25% – Surgical implant placement (D6010)

22% – Root planing and gum disease scaling (D4341)

22% – Restorative crown (D2740)

22% – Filling – two surfaces (D2392)

18% – Adult teeth cleaning (D1110)

18% – Four bitewings and x-rays for cavities (D0274)

12% – Root canal (D3330)

Paramount Group Health Insurance Coverage In Ohio

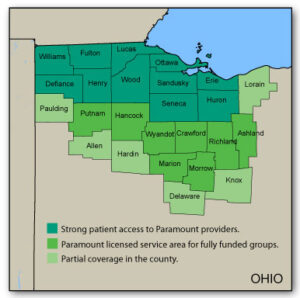

Eight types of employer-provided plans are available in the service area shown above. Comprehensive and lower-cost high-deductible policy options are offered at very competitive rates. Typically, when medical benefits are provided through an employer, Marketplace plans remain available, but a federal subsidy will not be offered.

HMO – Health Maintenance Organization with no required referrals for specialist visits. A primary care provider (PCP) must be selected to help coordinate your healthcare needs. Current plans continue to receive accreditation from the NCQA and a personal call center representative can be assigned upon your request. Discounts from physical fitness centers and department and online stores are also provided.

PPO – Preferred Provider Organization option offers substantial negotiated network discounts along with the option to receive medical treatment at non-network facilities (at higher out-of-pocket costs). Deductibles range from $0 to $6,500, with access to Cofinity, First Health, and Paramount Insurance Company networks.

CDHP – Consumer directed health plans are often packaged with an HSA or HRA to minimize worker healthcare expenses and provide flexible coverage options. Provider networks include various PPO options, Paramount, Encore Health Resources, and HAP Preferred.

Alliance Plans – Fully-funded groups with 1-50 employees are eligible. Membership with a participating organization is required. Several of the memberships include: Toledo Better Business Bureau, Northwest Business Coalition, Home Builders Association, and the following Chamber Of Commerce organizations: Bowling Green, Defiance, Erie County, Fostoria, Maumee, Oak Harbor, Swanton, and Sylvania.

Medical Home – Paramount Medical Home is offered to large groups and rewards their workers for better health and wellness. Physicians are also also eligible to receive incentives.

POS – Point-Of-Service plans are popular with large groups that desire increased flexibility with the plans they offer to employees. Coverage is available outside of the HMO network.

MEWA – A Multiple Employee Welfare Arrangement is fully funded for businesses with less than 50 employees. MEWA is often an affordable alternative to Obamacare plan options.

ASO – Administrative Services Only products provide options that can potentially lower costs, and offer flexible coverage. Services offered include: actuarial services, claims administration, enrollment assistance, material distribution, medical management, member enrollment and services, network management, outbound data transfer, and wellness programs.